Fed Meeting Tomorrow

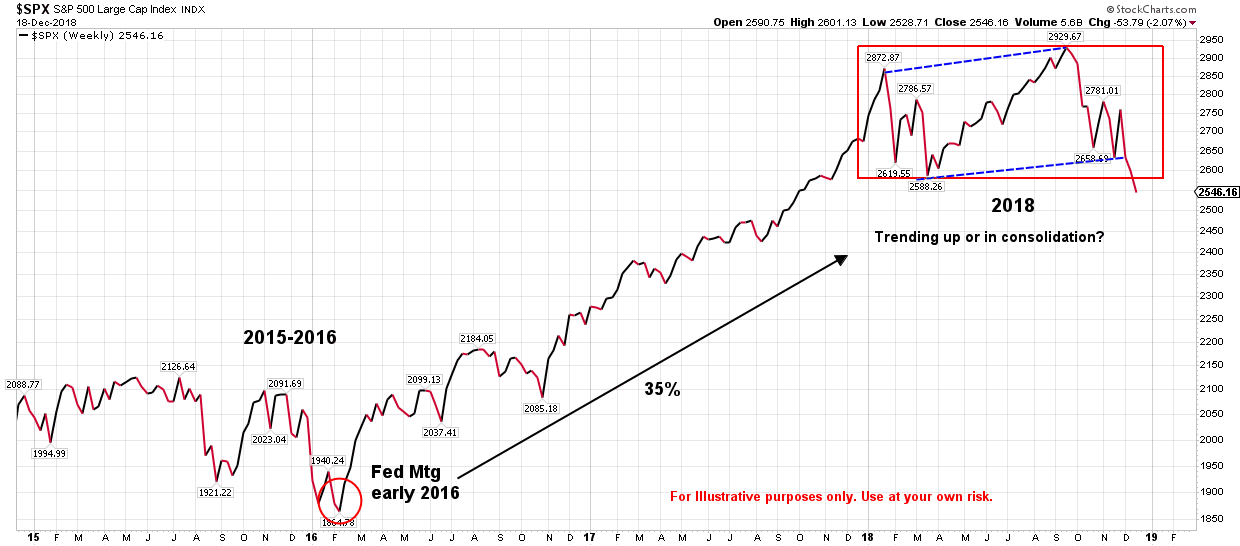

Tomorrow the Fed meeting takes place and the outcome could have a significant impact on the stock market. In early 2016 the Fed backed off their hawkish stance and the S&P 500 rebounded and trended up into January of this year around 35% (See chart below). While this could certainly be the case again, the more prudent course of action is to continue to be defensive.

I posted the chart above last month to ask if the S&P 500 was still in an uptrend or is it consolidating. As can be seen, after the close today the S&P has broken down out of the uptrend and out of consolidation which has triggered more defensive measures. If the Fed meeting doesn’t offer anything positive tomorrow, then we will continue an incremental approach to a more defensive position.

It’s important to maintain maximum flexibility as we move forward. The China trade wars have improved and there has been no inversion of the yield curve (as we discussed in a previous post) and these are both positive factors. Yet the market has continued down which means there is something else that is worrying investors. It could be the slow global growth we are seeing or the question of whether or not the Fed will hike rates again. Or it could be both. It is impossible to know where the bottom of a downtrend is going to be with any certainty so we will continue to be patient as well and be in a position to to advantage of a reversal in the markets.

This post is written to describe our approach to evaluating markets in more generic terms. It is provide to help readers understand basic concepts and not any specific strategy.