Ten weeks ago, on July 1, 2022, we were wondering if the stock market had reached the bottom yet. At that time, I wrote that the economic data coming out was not positive and stock buying was not happening at that time, so the markets might not have reached the bottom yet. But during the next two weeks, a pattern started to emerge that indicated we might have reached the bottom as market prices and their indicators began to improve. Looking back, around the middle of June all of the indexes seem to have hit bottom and have moved upward since then—until this week. This week a new inflation report came out, which put the brakes on the markets.

Inflation Still Hanging Around

When the latest inflation report came out Monday, it took the stock market by surprise. The experts thought the lower gas prices we’ve experienced recently along with economic growth that has been slowing would result in inflation being negative for August, but the Consumer Price Index (CPI) was up a tenth of 1% over July CPI. As a result, the markets expect the Federal Reserve to raise interest rates again next week, which resulted in a lot of selling in the markets on Tuesday. You can really see the domino effect of the actions of both consumers and government agencies. So where does this leave us?

Bottom Is In, For Now

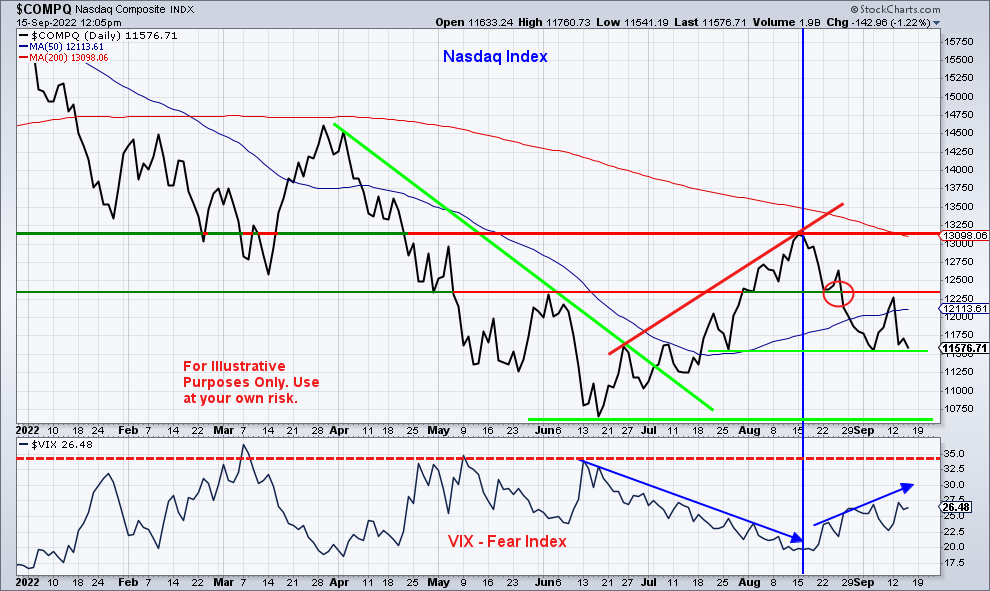

I’ve posted this chart of the Nasdaq several times the last few months. In it, we can see the progression of the markets and how they react to economic news. The smaller chart attached below the index is the market volatility index or VIX. Around the middle of June, the Nasdaq hit its lowest point, and the VIX had peaked. From there, the VIX began to trend down, and the Nasdaq trended up for the next 8 weeks until the end of August—when the Federal Reserve chairman announced that they would continue raising rates as long as inflation was hanging around. At this news, fear began to rise, and the index price fell.

Nasdaq Finds Resistance

After a short recovery, inflation reared its head, and some panic set in. But even with the unsettling drop that occurred this week, so far, the Nasdaq has managed to hold its ground at the previous September low, which is still 9% higher than the June bottom. The fear index also seems to be holding between 26 and 27, which means it could have its limits. If the price can hold around this level through the week, there’s a good chance it could begin to move up again in the following weeks. But if does not hold, we could revisit the June low. To feel more comfortable, I would like to see the price get back above the 50-day moving average again and the VIX move down around 20 or lower. This would instill greater confidence for investors to begin reinvesting in the market.

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options.