The last few weeks, financial news talking heads have been beating the drum about recession possibilities due to an inverted yield curve. While I suspect there might be political reasons for their commentary, I want to address some of the factors surrounding an inverted yield curve.

First, what is an inverted yield curve? It is a description of the comparison between the 10-year Treasury note yields and 2-year Treasury note yields. If the 10-year is yielding less than the 2-year, then we have an inverted yield curve. Typically, 10-year rates are higher than short-term rates because investors require a higher rate of return to own long-term bonds.

Historically, just because the yield curve inverts, that doesn’t mean the economy is doomed. While inversions have signaled a slowing down of the economy, if a recession happens, it occurs on average 19 to 24 months after the inversion takes place. Looking back to when the last two yield curve inversions took place in 2000 and 2006, these events were followed by an average gain in the S&P 500 of 32% over the next two years. So, if we are headed for a recession, there is still plenty of time to react accordingly.

Additionally, there are other factors at play. Currently, the unemployment rate is very low, obviously interest rates are low, and commodity prices are low, as well. Typically, when we see an inverted yield curve, commodity prices (i.e. lumber, corn, beef, copper, coffee, natural gas, etc.) are on the rise, and that is not the case this time. At least not right now.

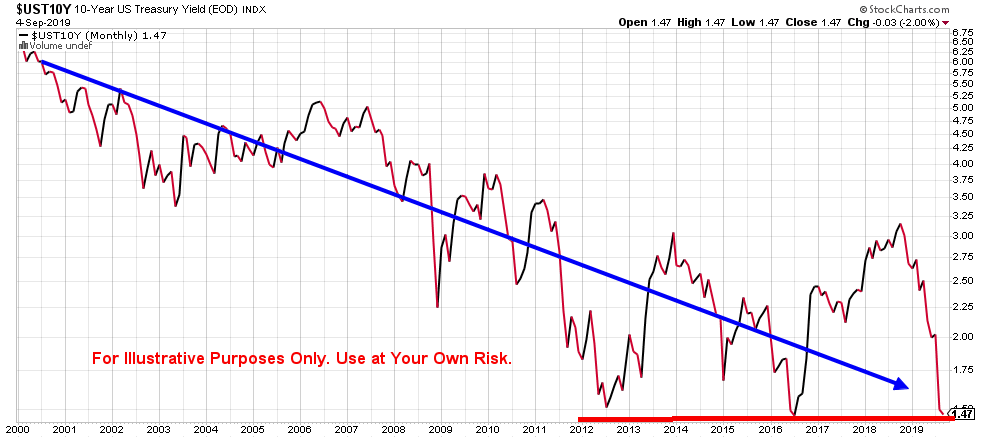

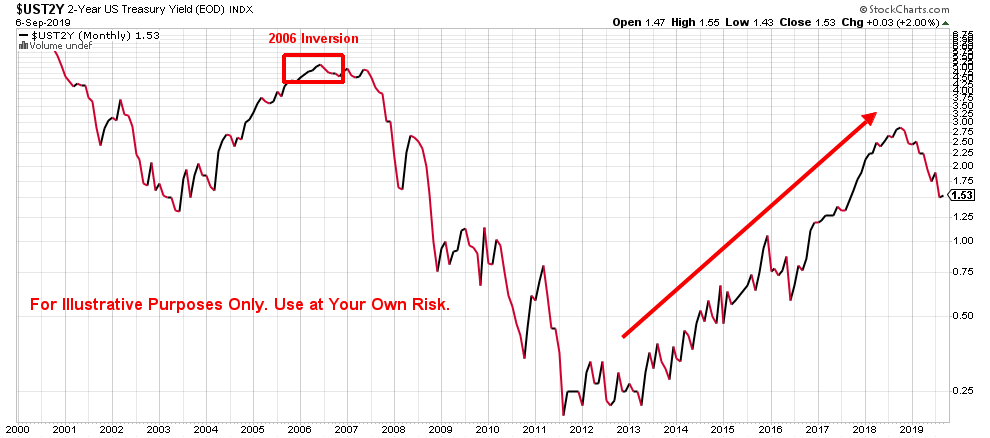

Finally, for the last 20 years, long-term rates have continued to trend downward, which has compressed the distance between short-term

and long-term rates. Because of this compression, the probabilities of a yield curve inversion becomes more likely. The following two charts explain this compression. The first chart below illustrates the downward trend of the 10-year US Treasury yield since 2000. The second chart is the 2-year US Treasury yield which has been trending up since 2012.

So while it’s possible that the inverted yield curve foretells a future recession, the probabilities do not seem to be as high as they were in past inversion events due to differing economic factors that usually coincide with a recession. So continuing to stay flexible and examining current conditions as they occur will allow for making adjustments to the investment plan.