This Is How Bear Markets End

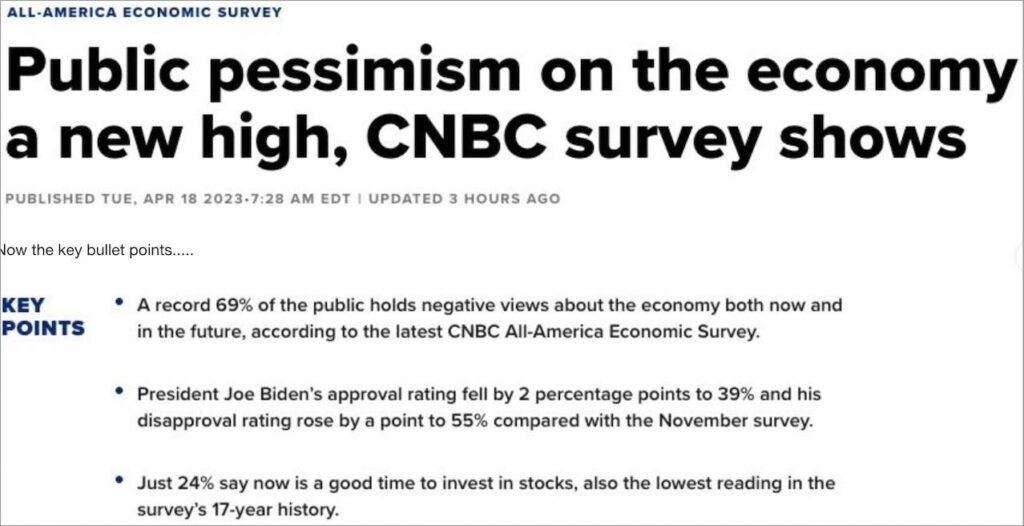

This headline appeared on the CNBC website on April 18, 2023. In order to end a bear market, investors have to be so beat up that they think they may never own stocks again. CNBC’s survey shows only 24% of those surveyed think now is a good time to invest in stocks—the lowest reading in 17 years of doing the survey. This type of sentiment is exactly what I look for because sentiment is a contrarian indicator for the stock market.

Behavioral Finance teaches us that the average investor typically gets into and out of the market at the wrong time. Buy high and sell low is typical behavior. Baron Rothschild, an 19th century nobleman, is credited with saying that “the time to buy is when there’s blood in the streets.” That time is upon us.

Blood in the Streets

The rising interest rates that contributed to the collapse of Silicon Valley Bank earlier this year have begun to damage other sectors of the economy as well, like commercial real estate. WeWork is a company created on the principle that wide open work spaces dedicated to freelancers and entrepreneurs would flourish with the growth of the gig economy. The concept boomed until Covid hit and work-from-home became the norm. WeWork had leased a lot of space in buildings in large cities and paid for it with adjustable debt. As interest rates climbed, so did their debt—to the point that they are now on the verge of bankruptcy. Below is the WeWork stock chart in freefall.

Besides the new normal of work-from-home, Covid lockdowns brought on the mass migration of people from the cities to the suburbs leaving a tremendous amount of office space empty in large cities that is not going to be occupied anytime soon.

Why Is This Good News?

The demise of commercial real estate and regional banks has dominated the news lately along with Federal Reserve meetings and whether they will or won’t they raise interest rates again. Most people just assume that the markets are still falling or that any uptick in stocks will be short-lived and the bottom will drop out again. But take a look at the S&P 500 chart I posted on March 1st that shows the higher highs (HH) and higher lows (HL) it has made since October 2022.

Now, two months later, look at the far right side of the same chart.

The S&P 500 has made another higher high over the last two months despite the slate of bad news that keeps coming. It is certainly possible for the market to drop again, but the probabilities have improved with regard to whether the market will continue moving up.

Even though commercial real estate is struggling, there are other sectors of the economy that have improved. Technology and communications services have done well over the last six months, and these types of sectors usually are the leaders out of a bear market and into the next bull market for investors. As always, be patient and look for opportunities especially when sentiment is poor.

_____________________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.