Historically, the worst time of the year for stocks is between July 17th and September 26th. But in an election year, August is one of the best months—a trend that may hold true this year as well, or not.

Federal Open Market Committee Meeting

The biggest news of the week came from the Federal Reserve meeting yesterday. While the Fed officials voted to stand pat on interest rates for now, Fed chair, Jerome Powell, hinted that there might be a rate cut coming in the next meeting in September. Inflation appears to be slowing down, and the jobs market is tightening up which could give them the confidence to go ahead and cut rates.

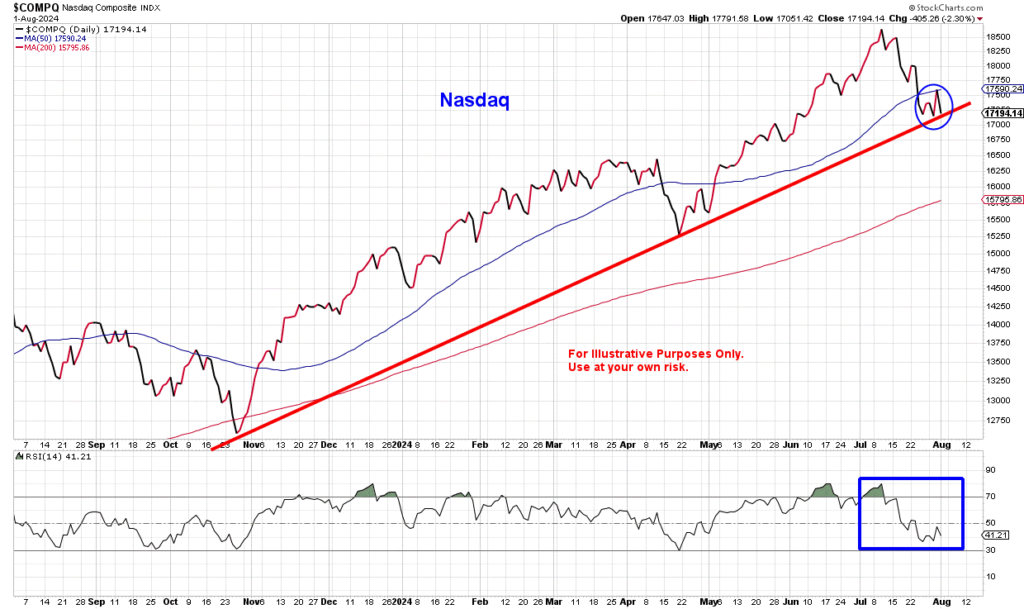

This was the news the markets have been waiting to hear all year. The Nasdaq had fallen almost 10% since mid-July but finished Wednesday up almost 2.5% after hearing the Fed chair’s comments. Below is a daily two-year chart of the Nasdaq that shows that both dips since November of 2023 have stayed within the bottom of the upward sloping trend line. Note also in the blue box at the bottom of the chart that the relative strength of the Nasdaq had turned up and is heading back over the 50% line which indicates strong momentum. Finally, the Nasdaq also pushed back over the 50-day moving average which should support broader market participation.

One Day Later……

But today is a new day and when new economic data was released the markets began to pull back. See the same Nasdaq chart below, only one day later. All the gains from yesterday are gone and momentum has disappeared.

Jobless Claims and Manufacturing Data

Jobless claims jumped to a one year high while manufacturing data fell to its lowest point this year and we still have non-farm payrolls and employment data to be released on Friday.

Typically, the markets would react positively to this news as it would guarantee a rate cut, but Wall St. has moved past that and now fears that the Federal Reserve has waited too long to cut rates which will result in the economy falling into a recession. At the June FOMC meeting the statement released by the Fed mentioned they were concerned with inflation risks. But the latest statement now reads that the FOMC “is attentive to risks to both sides of its dual mandate.” The dual mandate is to maximize employment (economy) and stabilize prices (inflation). So, the Fed is now acknowledging that the economy is weakening which today’s economic data has confirmed. Time to start cutting rates.

As always, having plans in place to cover different investing scenarios is important and also allows for the elimination of emotions in decision making.

_______________________________________________________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.