My investing strategy is focused on three areas with regards to investing—economic fundamentals, price charts, and politics—not necessarily in that order. I usually don’t cover all three in any commentary, but today I will because of all the uncertainty we are facing in the economy.

FOMC and Deficit Spending

Yesterday the Federal Reserve announced that they were holding interest rates steady for now with the possibility of a couple of cuts later in the year. Even though the rate of inflation was lower (2.8%), the Fed expects a mild stagflationary economy, though they aren’t even sure about that. With the Trump tariffs and possible tax changes coming this year, the Fed policy is on hold till they can evaluate the impact of Trump’s policies on the economy. During President Trump’s first term, the Fed was not very successful at predicting the results of the president’s policies as he surpassed their forecasts regularly. But we are in a much different place this time.

It’s not news that over the last 4-5 years the government has pumped trillions of dollars into the economy, and based on the first few weeks of the Trump administration, that is going to slow down significantly. Many of the economists I’ve read or listened to believe that the past few years the private sector has already been in a recession, but the overall economy was being held up because of the massive government spending taking place in contracting and hiring. Now we have the unwinding of all the massive deficit spending—an act that could cause some pain in the short run.

Tariffs on the Way

The immediate concern is the tariffs that will go into effect on April 1st. President Trump has a history of using tariffs as leverage in negotiating trade policies with other countries. Oftentimes, just the threat of a tariff has evoked a positive reaction in the U.S.’s favor, so it remains to be seen how many of the tariffs will actually go into effect. This will also influence the next earnings reports coming soon. Those earnings reports are going to be filled with revisions to previous guidance that either widens or lowers potential earnings for the next however many quarters. Some of this is already built into the market at this point (-10% correction) with institutional investment firms, but the retail investor may be in for a shock.

Ukraine War

Another unknown is whether or not an end to the Ukraine war can be negotiated. I’m not going to pretend to understand all the ins and outs of that conflict, but, if an agreement can be reached, that could also have a ripple effect in calming down some of the conflicts in the Middle East. That would be a big confidence boost for investors and the economy, especially when it comes to energy prices. If energy prices come down, then that should bring down prices on a lot of other goods and services. We’ll have to wait and see what happens there.

Uncertainty and Volatility

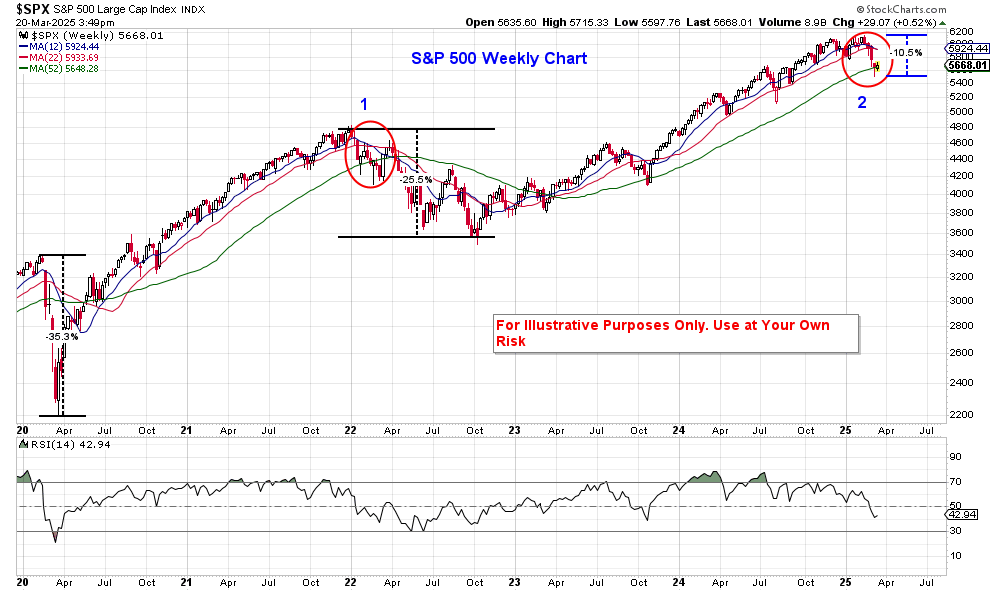

There are a lot of unpredictable moving parts to consider right now in the investment world, which creates volatility and uncertainty. The one thing the markets do not like is uncertainty—illustrated in the S&P 500 chart below. Currently the S&P 500 is down over 10% from the all-time highs in January and the momentum as seen in the bottom panel (RSI) is below 50. Back in early 2022, highlighted by the #1 red circle, the 12-week moving average (blue line) had moved below the 22-week moving average (red line) with the price down around 10%. Currently the S&P 500 highlighted by the #2 red circle looks very much like the #1 red circle back in 2022. Looking back at early 2022 there was just as much uncertainty as there is today with the start of the war in Ukraine, rising interest rates, and the effects of Covid-19 still firmly in place. The market trended down from January until the beginning of October that year, ending with a 25% correction before it bottomed and started climbing back up.

The market could certainly bottom right here and start the next leg up, but with all the uncertainty we are seeing, the probability is higher that the markets will continue to drop. It’s impossible to know if there will be another 25% correction or if the uncertainty will fade, but the speed in which this administration has moved so far indicates there could be answers sooner rather than later. Regardless, taking a more conservative mindset and preparing for a correction is a more prudent course of action. There will be some very good opportunities available in the coming months, and we want to be ready to take advantage of those as they present themselves.

_______________________________________________________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.