The Impact of Elections on the Markets and Tax Policy

With three weeks to go, we are now in the final stretch of the 2024 presidential election race. As we follow the news and parse the most recent polls, some may ask, “How might what happens on November 5 impact my investments?”

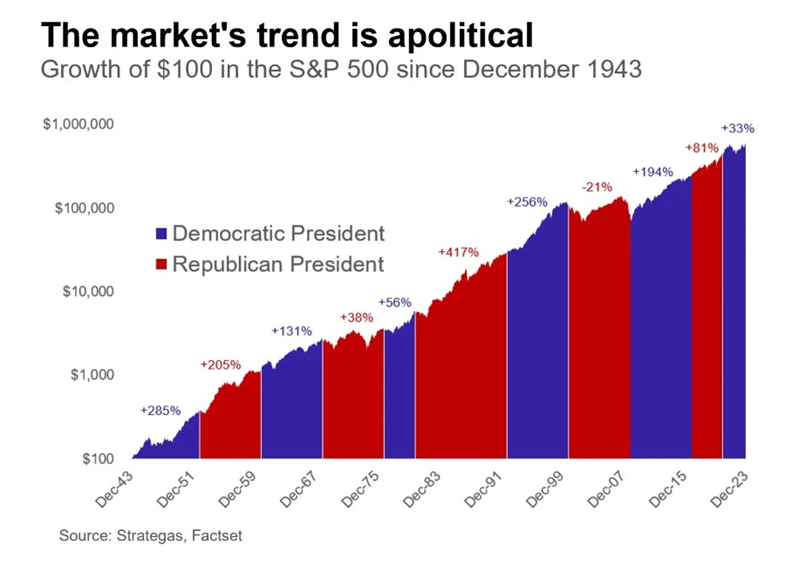

As an investment advisor, I’ve done some research and come to the following conclusion: you may care passionately about who wins, but your investment portfolio probably doesn’t.

Markets Over the Long Term

(Stocks are measured by the Standard & Poor’s 500 Composite Index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.) https://www.bairdwealth.com/insights/market-insights/baird-market-strategy/2024/03/all-that-matters-elections-and-your-money/

Consider how the stock market has performed under Republican and Democrat presidents throughout history. As the above chart shows, the stock market has fluctuated under the leadership of both parties. However, the long-term trend suggests that the stock market’s performance may have more to do with the overall strength and resiliency of the U.S. economy than the person who sits in the Oval Office.1

_______________________________________________________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.