The October 28th FBI announcement that they were looking into more emails that involved Hillary Clinton exacerbated what had already been a short-term weakening in market indexes. This weakening continued through last Friday until the FBI suddenly announced this past Sunday that they didn’t expect this latest batch of emails to change their previous conclusion about Hillary. The S&P futures market gapped up 25 points and carried this momentum through the trading day today (Monday 11/7) and closed up 46 points.

I don’t think this necessarily means that the stock market would prefer Mrs. Clinton over Mr. Trump, but the market does not like negative surprises. Wall Street was simply expecting her to win this election and when the FBI threw a curveball, Mr. Market was not ready for it. Recall the Brexit vote in June when elected officials and the media in Britain were expecting a vote of “remain in the EU” and the result was “leave the EU.” After that quick selloff, everyone decided it was really not that big a deal, and the markets recovered.

Again, I don’t think that Wall Street necessarily favors one candidate over the other as much as they just want to feel like they know what the outcome is going to be. That being said, recent history has shown that polls can be way off, and the anticipated market reactions can be way off as well.

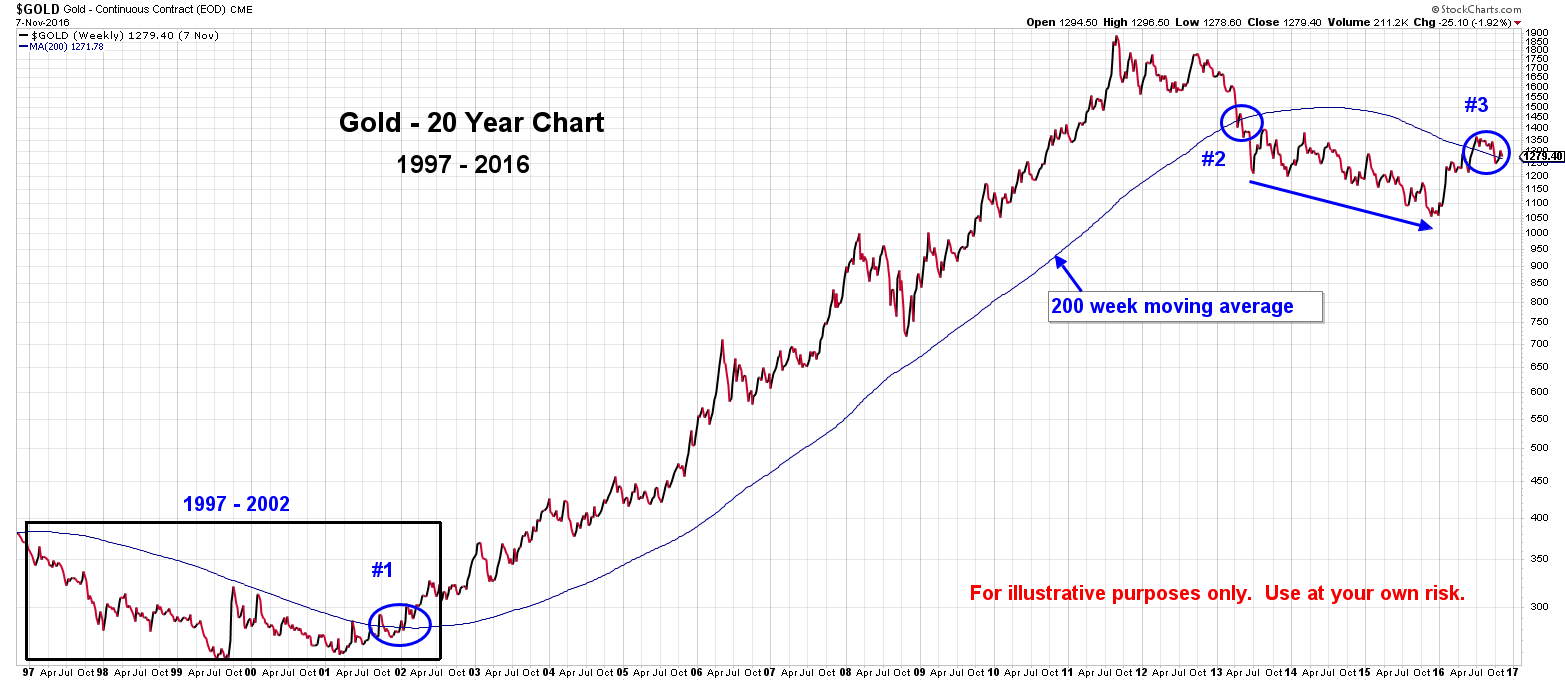

The best course of action is to be prepared and have plans in place that fit several outcomes. As an example, take a look at the chart below that illustrates the price of gold over the last 20 years.

The blue line in the weekly GOLD chart represents a 200-week moving average. From 1997 to 2002, you will notice the price of gold stayed below the moving average. At point #1 (2002), the price of gold breaks through the moving average, and for the next 11 years good things happened for owners of gold. In 2013, point #2, the price broke down through the moving average and trended down until early 2016, when at point #3 gold moved back up through the blue line and is attempting to establish an upward trend once again.

This is simply one example of having plans in place regardless of the outcome of elections, or the direction of the economy, or the level of interest rates, etc. There is no guarantee that gold can re-establish itself, but if it can maintain its position above the 200-week moving average and the slope of that average begins to turn up, the probabilities of an uptrend in gold increase.

Regardless of whoever wins, remember that elections are events and events typically have a short-term effect whether positive or negative. Keep an eye on the big picture, and filter out the noise. Thanks.

#gold #marketcommentary #2016 election

Recent Comments