January Federal Reserve Meeting

On Tuesday, Federal Reserve Chairman Jerome Powell said a rate cut in March was not likely. Apparently, some on Wall Street thought this was a possibility, and with Mr. Powell’s statement the stock market closed lower.

The Chairman did say that the economy has made good progress, and the supply-and-demand conditions in the labor market have come into better balance, along with slowing inflation. But the Federal Open Market Committee (FOMC) as a whole need more data to see how quickly inflation is dropping toward their 2% target.

Mr. Powell also emphasized that the Fed is in “risk management” mode, and the timing of when to cut rates is critical. Cut too soon, and the progress made so far could go right out the window. So, the Fed is ready to hold rates steady for the foreseeable future. Now we wait for the March meeting to see if the data has improved enough to settle the committee members’ nerves somewhat.

Health of the Economy

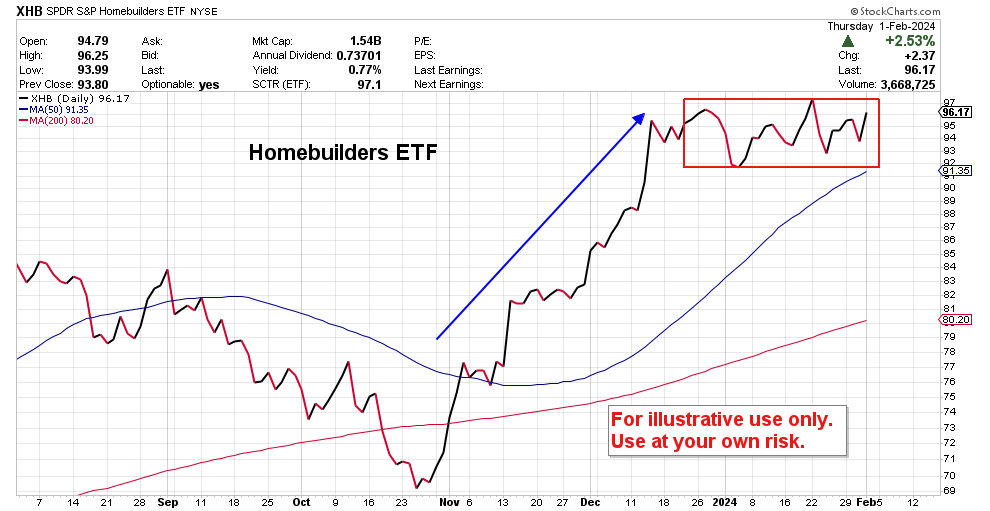

One of the best sectors to watch to gauge the health of the economy is homebuilders. The homebuilder ETF from iShares, ITB, is a good proxy for homebuilders. This sector has been volatile lately due to slowing sales and rising inventories. If potential buyers are feeling the stress in their finances due to inflation and are worried about keeping their jobs, then new home sales will start to feel the strain.

Below is a daily chart of ITB. While the sector finished 2023 strong, the last month seems to indicate that investors may be getting nervous that the Fed rate cuts may not be coming as soon as they previously thought—the ETF has moved sideways the last four weeks.

There are increasing signs that the U.S. economy is slowing. This affects middle- to lower-income brackets earlier, which dampens starter homes sales. Higher-income brackets may feel the pinch too, as layoffs are starting to include executives as well. If that’s the case, then we might see rate cuts as early as May. The bond market rally that has taken place during the last week seems to indicate that Wall Street is betting on rate cuts earlier rather than later this year.

________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.

Recent Comments