Good morning.

Yesterday I wrote in my Market Commentary “recent history has shown that polls can be way off, and the anticipated market reactions can be way off as well”. Well, I’d say the polls were way off and the initial market reaction in futures was way off as well. It turns out that the Brexit vote foreshadowed our presidential election and the polling industry took a massive hit to their credibility.

Last night the reports were coming in that the futures markets in all indexes were down around 5%. At the open this morning all those losses were recovered and the markets opened up and then moved back down to even as volatility kicked in. So this should be an interesting day. With the Trump election, whether you are happy or sad, it should change the overall business climate and improve the outlook for some stocks and sectors while damaging others.

During the coming weeks and months any trend changes will become apparent once we learn of the possible changes in tax law, healthcare law, trade agreements, etc. For example, the initial reaction is that the Fed will now raise interest rates next month which is reflected this morning in lower bond prices and higher prices in financial stocks. With the increased probability of major changes in the Affordable Care Act (repeal?) the health care sector funds have moved up heavily. Whether or not these initial reactions will continue is yet to be seen but the probabilities that they will have increased significantly and is reflected in the data of our ETF ranking models.

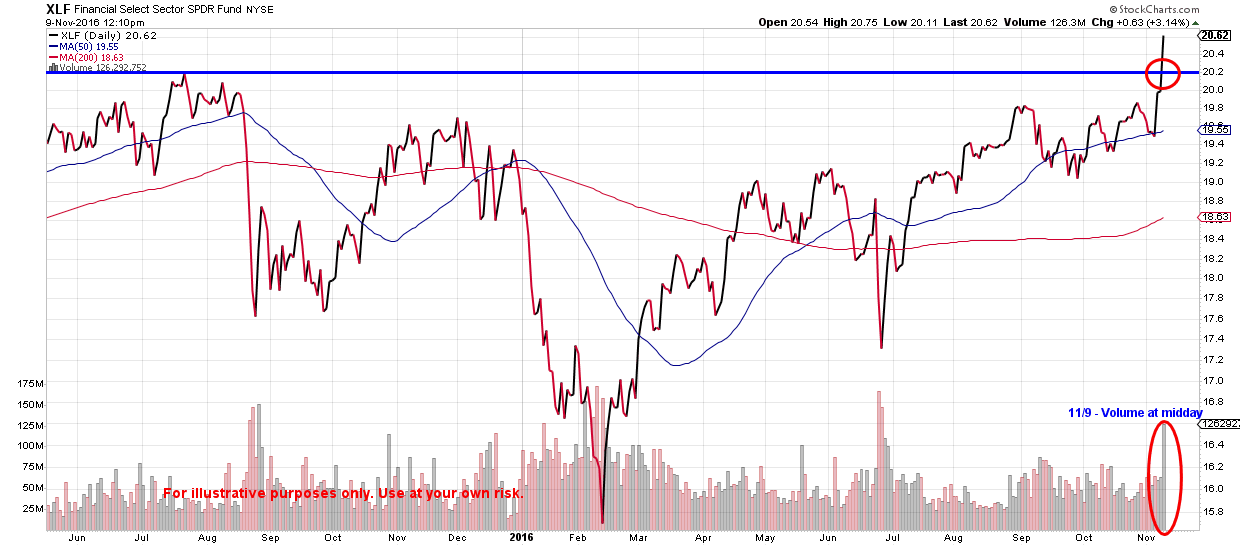

The financial sector fund below not only reflects the jump in price today but heavy buying volume only half way through the trading day which adds significance to the jump in price.

By the end of this week there should be more data available to confirm trend changes one way or the other in this and other sectors. As always, filter out the noise and don’t overreact to any news you might hear.

#2016Election #Brexit #electionpolling #stockmarket

Recent Comments