Merry Christmas!

I hope everyone had a wonderful Thanksgiving as well. As the year comes to a close, I wanted to point out a couple of things in regards to media, market trends, and interest rates that I think everyone should keep in mind.

First, if you watch or read any financial news this month or next month, you will probably see quite a few predictions for the stock market for 2018. Please take all predictions with a grain of salt because short-term predictions tend to be very untrustworthy.

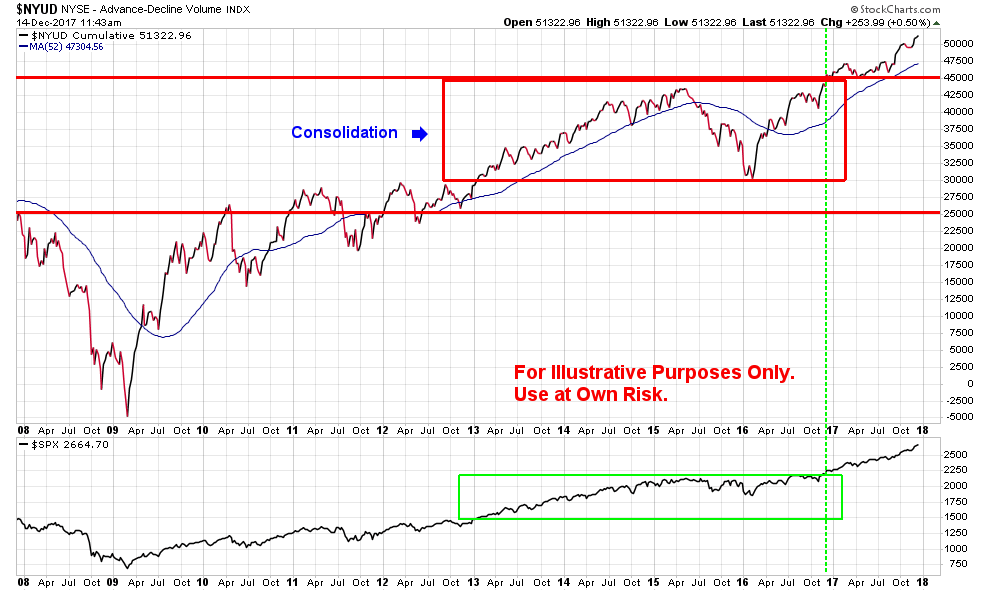

Second, long-term trends in the market are still looking bullish. To illustrate this, take a look at the chart below which addresses volume in the market. The rise or fall in volume helps determine the strength of the rise or fall in the stock market price. From early 2013 through December 2016, volume consolidated inside the red box below. But volume began increasing in early 2017 (note the green vertical line) along with the S&P 500 price (bottom of chart), which indicates that the current uptrend has been a strong one with a lot of participation.

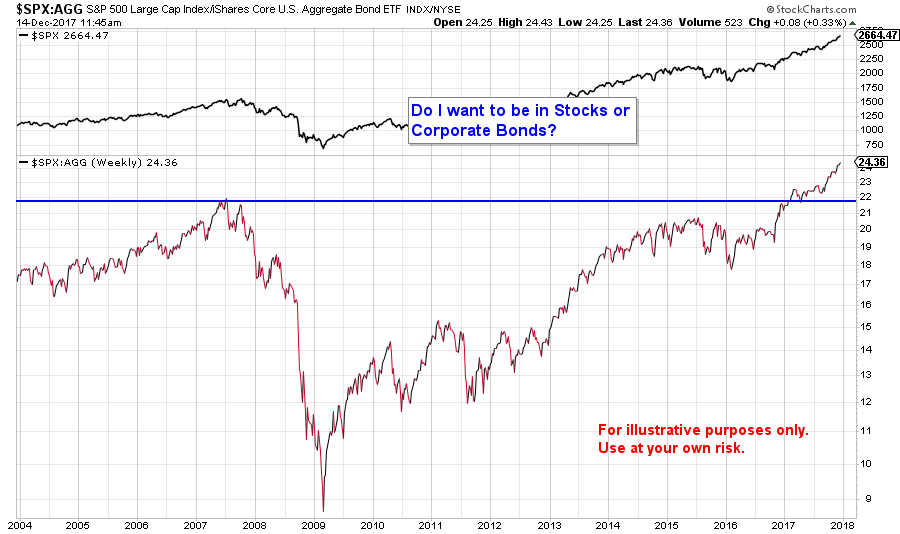

The next chart also verifies this trend by asking if it is better to be in stocks or bonds currently. This chart compares the strength of the stock market to the corporate bond market. The upward direction of the price indicated that more money is flowing towards the S&P 500 as opposed to corporate bonds and is more evidence that the current upward trend of the market is strong,

While I have no predictions for the market for 2018, these charts—along with many others (I didn’t include because I don’t want to overwhelm you)—give a very high probability for a continued uptrend into 2018.

Third, interest rate levels should remain relatively low in the foreseeable future. Recently I was watching a video (found on YouTube) by one of my favorite economists, Cullen Roche, and he made some very good observations. Inflation/Deflation trends have a significant impact on interest rates, and currently there are three deflationary issues that will have a big impact:

- Populations around the world are shrinking so demand is shrinking.

- The labor class has no power as unions have been crushed. This means wages are not going up.

- Technology is putting downward pressure on prices as efficiency in production increases.

Mr. Roche believes these three issues will keep the current low-interest rate environment in place and he makes a convincing argument. This is certainly something to consider, especially if you are in or heading towards retirement soon.

That’s it. Thanks for reading and have a Happy New year as well.

Recent Comments