As I mentioned in my last post, the current lows of the S&P 500 are still above the lows we saw last February. To begin a downtrend we would need to begin seeing lower lows and that has not happened so far. That could certainly still occur, and the probabilities of it happening have increased this week as the markets dropped heavily on Tuesday. While the week started off strong, on Tuesday the yield of the 2 year Treasury approached the same level as the yield on the 5 year Treasury. This produces an inverted yield curve which means the cost of debt for longer term borrowing is less expensive than borrowing for shorter term debt. Without delving too far into it, this is typically a negative sign for the markets and the indexes reacted negatively. One article I read suggested that the computer algorithms the large wirehouses use to trade have automatic sells set if the yield curve ever inverts. That could very well be the case this time, but this was just speculation. Another commentator swore it had something to do with Brexit in England.

Because the odds of the markets breaking down to lower levels has increased, it is important to have a plan in place to be more defensive. For clients of WIS, LLC such a plan exists and will be implemented if the market levels move below set resistance levels. Hopefully that will not be the case, but it is better to have a plan and never have to use it.

On a positive note, historically, the last two weeks of December are some of the best days of the year and that could add some strength to the market. If the markets do become more bullish, there is a game plan for that scenario as well.

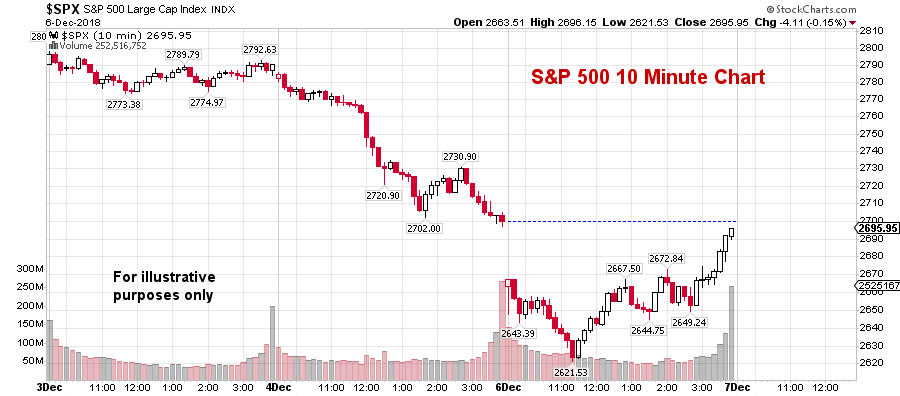

Lastly, this afternoon the yield curve has moved away from the inverted stance of Tuesday and the markets climbed back up to almost where they started the day. Considering the S&P was down 2% early in the day, this is a positive takeaway from the day. Below, In the 10 minute chart of the S&P 500, you can see this illustrated as well as the increasing buying volume as it moved into the closing bell. That’s a good sign for tomorrow but we’ll have to wait and see.

This post is written to describe our approach to evaluating markets in more generic terms. It is provide to help readers understand basic concepts and not any specific strategy.

Recent Comments