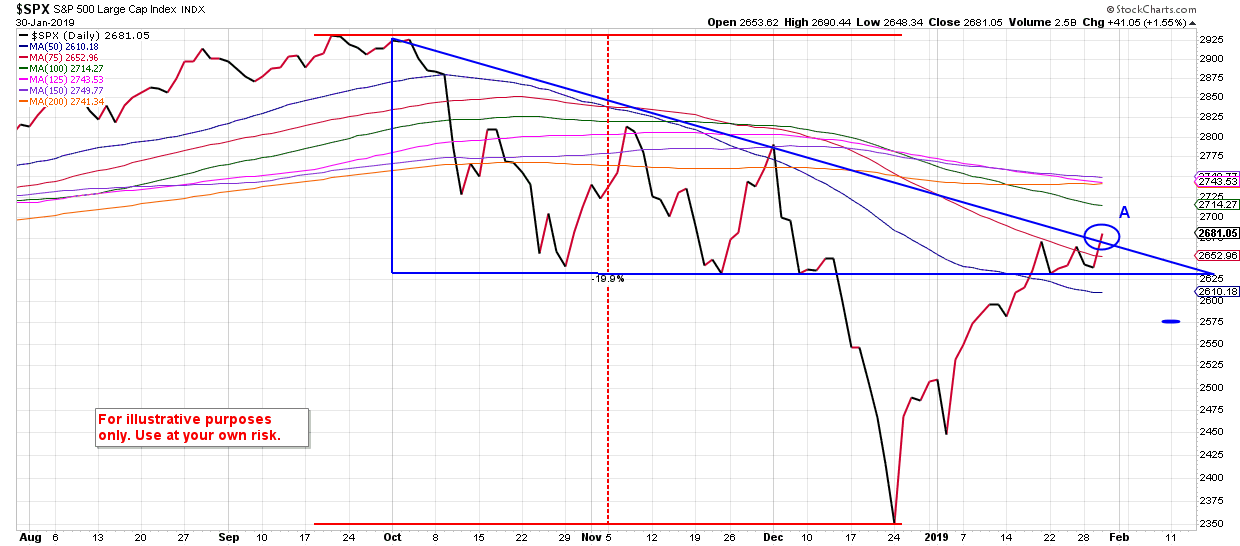

In the last 4 weeks, we have seen a pretty sharp rebound in the S&P 500 since its December lows. To think that it would retest its lows or at least retrace below the 2500 mark, would not be out of the realm of possibility. Frankly, that is typically what happens after a correction like the one that just occurred. Assuming that the stock market is healthy, then a correction is followed by a period of consolidation before resuming an upward trend. Just to be clear, this is not a prediction. I am simply stating what has happened historically. The prudent move at this time is to be patient and remain open to all possibilities while having a plan in place to take advantage of any bullish moves or become defensive in case of any bearish moves.

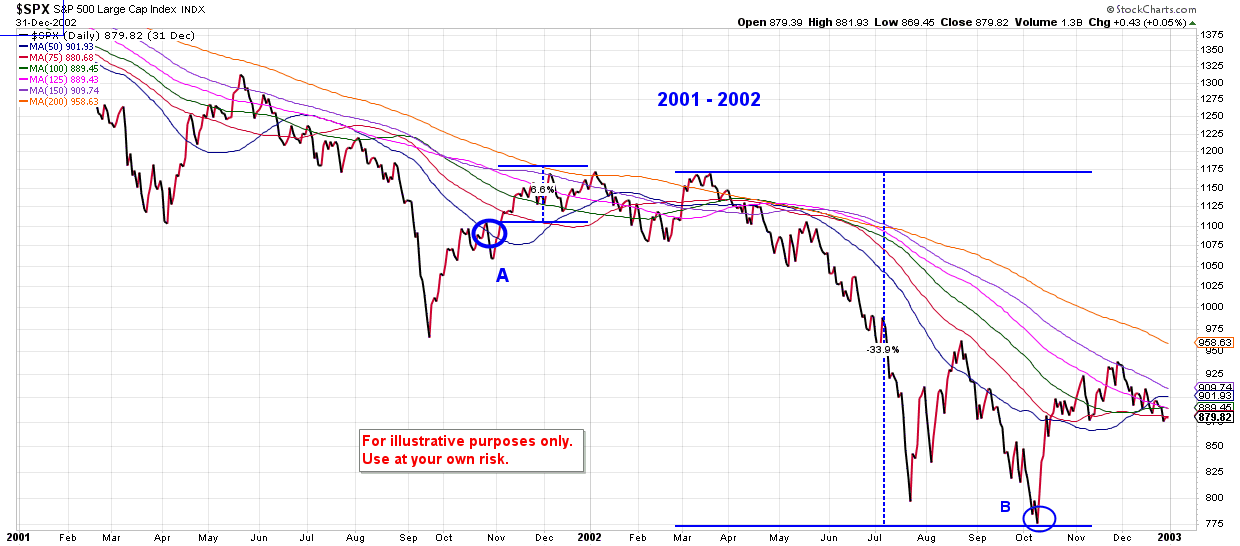

Why a bearish outlook needs to be considered can be illustrated by looking at a chart from 2001. The chart below shows the S&P 500 is about 6.5% below the 125, 150, and 200 day moving averages at point A on the chart which is in October of 2001. The S&P 500 had rebounded sharply similar to the rebound we have currently witnessed. But by October of 2002, it had fallen almost 34% from the October 2001 level which made the risk/reward scenario of entering the market in October 2001 very shaky at that time. Of course, in hindsight, we know that the economy was just beginning to feel the repercussions of the internet bubble and it would take some time to work through that.

Currently, the worldwide economy is giving signals that it may be slowing down, but earlier today the Federal Reserve released a statement that described the US economy as solid. The Fed also announced that they decided to leave interest rates alone for now as well as being patient on any future rate hikes. Reuters article linked: https://www.reuters.com/article/us-usa-fed/fed-leaves-rates-steady-says-will-be-patient-on-future-hikes-idUSKCN1PO0DO

Also, ADP reported that 213,000 jobs were created in January, which was higher than economists’ forecasts of 174,000.

https://www.marketwatch.com/story/213000-private-sector-jobs-created-in-january-adp-says-2019-01-30

Both pieces of news propelled the markets higher this afternoon. This is illustrated in the S&P 500 chart below at point A on the right side of the chart. The price broke through the blue, downward sloping line and out of some short-term consolidation which adds a little piece to the bullish outlook. As mentioned earlier, it is possible the markets could revisit the most current lower levels again, but it is also possible that prices can continue to move up in the coming weeks and increase the possibility of taking a more bullish stance.

So far this has been one of the best January’s in the stock market over the last 30 years, which has also been accompanied by exceptional breadth in the market. The next few weeks should be interesting.

Update 2-1-2019 : The Bureau of Labor Statistics released its employment summary for December 2018 and indicated that 304,000 jobs were created last month. https://www.bls.gov/news.release/empsit.nr0.htm

Recent Comments