Yesterday, Federal Reserve Chairman Jerome Powell put a damper on any talk of a recession that still lingered in the media. Here is the quote from the Yahoo Finance article linked below.

“In principle, there’s no reason why it can’t last,” Powell told the House Budget Committee in testimony. “At the risk of jinxing this, I would say that in principle there’s no reason to think, that I can see, that the probability of a downturn is at all elevated.”https://finance.yahoo.com/news/federal-reserve-chair-powell-on-economic-expansion-184600258.html

Powell also said the current expansion seemed to be sustainable because he didn’t see the kinds of warning signs that one would typically see that would indicate a recession is imminent.

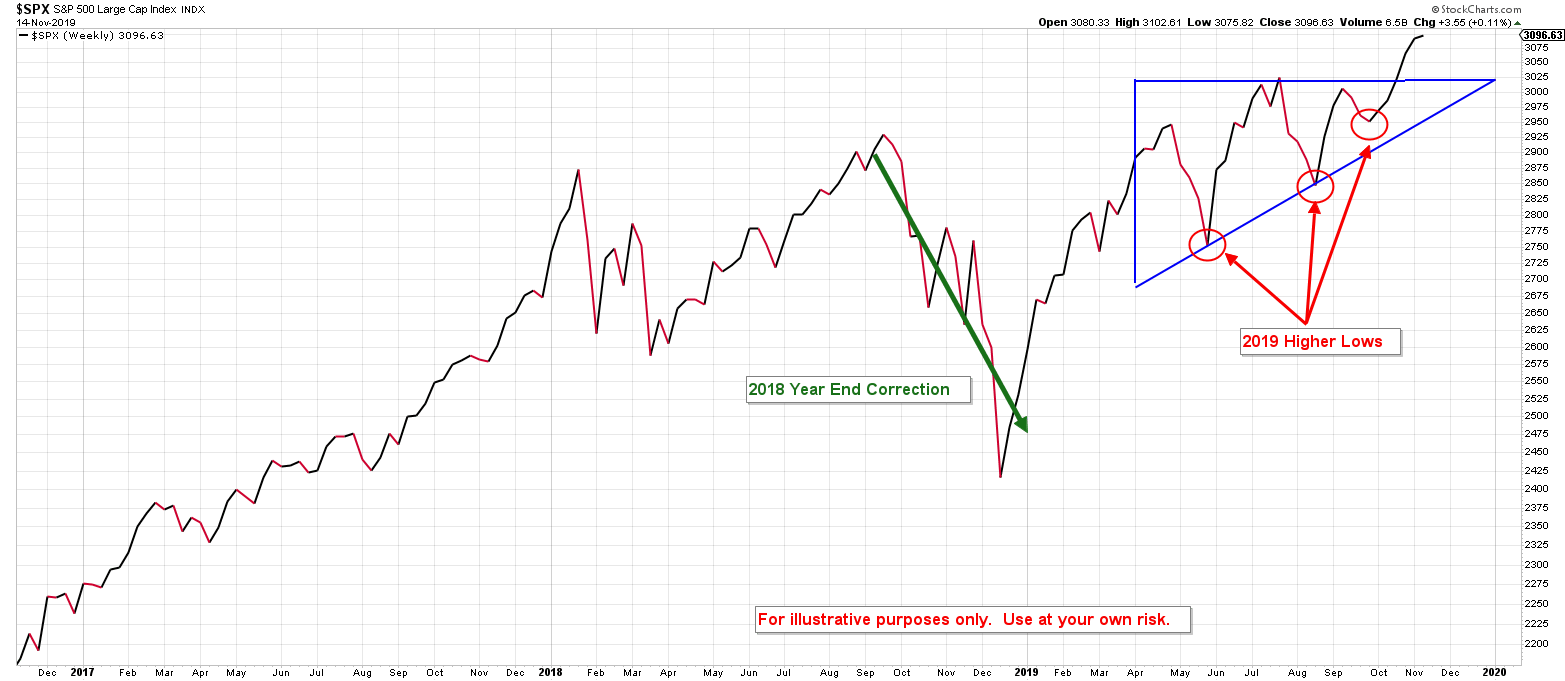

With that in mind, take a look at the S&P 500 chart below. After a 20% market correction at the end of 2018, the S&P 500 rebounded quickly into 2019 until the month of April where we began a series of ups and downs that really went nowhere until mid-October where a breakout seems to have occurred. While we had some new highs from April to October, none of them were very significant. What was significant were the lows that occurred. All three lows during this time frame were higher than the previous low which typically indicates that momentum is building in the index.

At the close of the market yesterday, the S&P 500 is up 2.25% in November which gives support to Chairman Powell’s statements and should quiet most of the recession predictions for a while. Unemployment is low, interest rates are low, energy costs are low (except in California), and consumer balance sheets are in much better position at the end of the decade than they were at the beginning which seems to have boosted investors’ confidence as we move towards 2020.

As always, unforeseen one-off events can certainly affect the direction of the market in the short term, but the probabilities of the stock market continuing to move higher in the intermediate to long term certainly look to be positive.

Recent Comments