April 17, 2020

So here we are in week 3—no 4, or is it 5?—of this shelter-in-place business due to COVID-19, and so much has happened, despite the fact that many of us are unable to do anything. Last month, the markets shot down 35%, an alarming rate. The potential for a 50% drop was easily within reach, until news of a government stimulus package and the Federal Reserve stepping in to backstop the banks. At that point, markets stemmed the tide and allowed a 15% rebound.

This week begins quarterly earnings reports for many major corporations, and expectations are low. Expectations are also low for the upcoming unemployment numbers, which probably won’t surprise anyone from an investment point of view. So, has the market already anticipated the bad news and corrected for it? Stock markets are typically forward-looking systems, and they don’t react to current good or bad news unless something out of the ordinary happens. So, the probability of bad news causing a 20% drop in market indexes is pretty low currently. The question now is, when will we be able to get back to work, and how long will it be before things get back to normal?

I have been reading blogs of several economists who are equating our current situation with the start of a depression. I do not agree. In reality, this is more along the lines of a natural disaster and the requisite self-imposed shutdown that would typically follow. It is not the result of an irresponsible asset boom, like those we witnessed in 2001 and 2008. Instead, it is the result of a virus that is hurting innocent people. The hardest hit are those who did nothing wrong during our economic expansion, but now they cannot work, primarily because the government has told them they can’t.

The economy was in good shape before COVID-19. Many of the factors that drove a strong economy are still in place—things like low energy prices, low interest rates, and a stable infrastructure. Naturally, some industries and some regions of the country will take longer to recover than others. And changes in supply chains from China to other parts of the world will also take time. I’ve read predictions of recovery to be anywhere from 6 months to 2 years, but the reality is probably somewhere in between. This week, President Trump and some governors, including Governor Abbott, have been talking about plans to reopen the economy and get people back to work. Yesterday, President Trump presented guidelines to begin reopening some states before May 1st. Click this link to see a PDF of the plan: Opening Up America Again

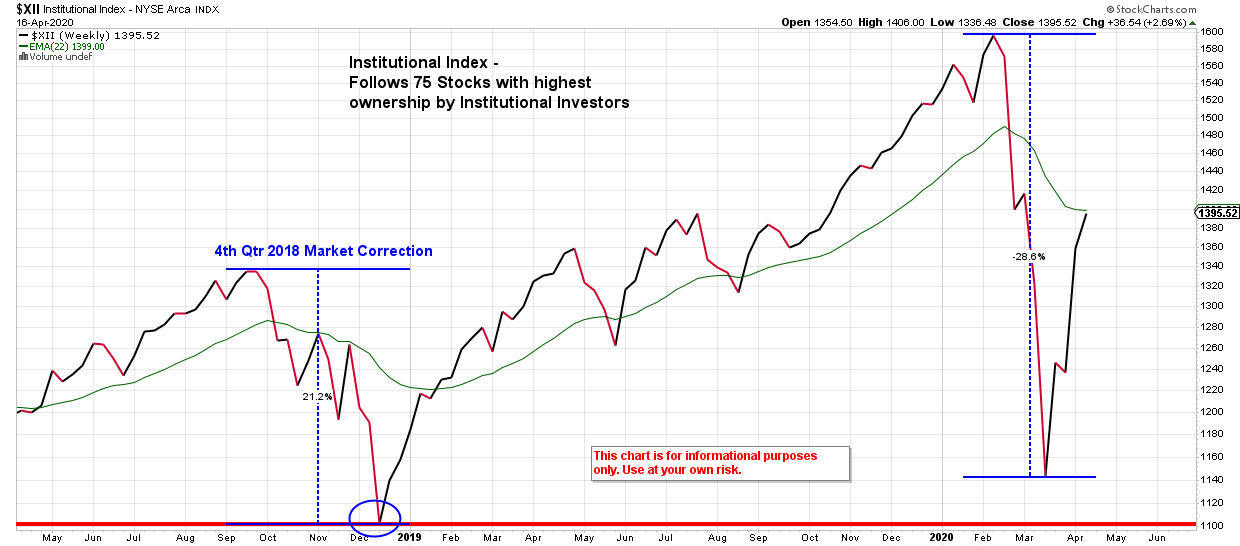

One of the charts I’ve been watching during this time is the Institutional Index, which is posted below. During the recent correction, the DJIA (Dow Jones), NYSE, and the S&P 500 indexes all receded below the lows we saw in the 4th quarter of 2018. The Nasdaq did not go below its 2018 low, and neither did the Institutional Index. The Institutional Index tracks the 75 most widely held stocks of institutional investment firms. Examples of institutional investors include banks, insurance companies, investment advisors, and fund managers. This weekly index helps give insight into what Wall Street is thinking and likely to do moving forward. The left side of the chart shows the bottom of the 2018 4th quarter correction; the right side shows the bottom of the current correction. While the correction has been more severe this time, this index is staying above the previous correction’s bottom line. This indicates institutional investors’ higher level of confidence in these stocks, and their ability to recover quickly. We can also see how quickly the correction took place, starting in February and bottoming about 4 weeks later. The 2018 correction began in September and didn’t bottom until 3 months later. This level of volatility seems to indicate that even Wall Street was caught off guard and didn’t see this crisis coming.

Historically, rebounds in the market include dips, and that will probably be the case with this one, as well. These dips, though short term, could be as much as 10% or more. That means this time frame will allow for better opportunities for investors who are paying attention can take advantage of.

As I wrote last month, we are in uncharted waters in nearly every area of life. So, please be careful. Stay safe. But take advantage of this unique time with family. Catch up on your reading, work in your flower beds, or do whatever you haven’t had time to do in your typically busy schedule to do. Also, take the time to reflect on what you are thankful for. I have had the opportunity to spend a lot of time with my wife, and it has been wonderful. I’m not sure she would say the same thing about spending time with me, but she’s put up with me with great patience and love.

Take care, and let me know if you have any questions.

Recent Comments