We’re all acutely aware of prices at the pump. In fact, my wife showed me a recent Facebook picture of a friend who filled up his pickup truck to the tune of $172.01. We’ll talk more about how high gas prices impacts our bottom line on everything, but let’s dive into the reasons why this is happening.

Federal Reserve vs Inflation

The Federal Reserve is in a bind because they need to raise rates to combat inflation, but in order to do this, they run the risk of a recession. It’s not unrealistic to think we may already be in a recession, but there have been plenty of news articles out there touting a slow down in the rise of inflation (8.5% in March down to a “whopping” 8.3% in April) and a 3% growth in the economy this quarter, which is up from a -1.5% in the 1st quarter. Well, the Consumer Price Index (CPI) numbers for May came out Friday showing consumer prices 8.6% higher than in May 2021. That’s a 40-year high. This also means that if the Fed was thinking about easing up on interest rate hikes, they aren’t anymore. Last year, the Treasury Secretary, Janet Yellen, and the Federal Reserve Chairman, Jerome Powell, were assuring everyone that inflation was “transitory” and would abate before the end of 2021. Secretary Yellen recently admitted that she might have been wrong about inflation—an error that doesn’t instill a lot of confidence in this administration’s ability to turn the ship around.

Inflation Hits Home

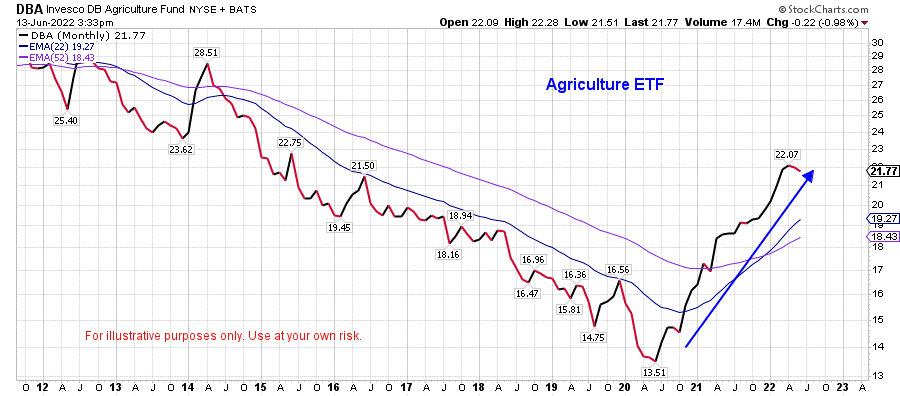

Here’s a look at inflation since 2020. Prices of goods in most sectors of the economy are either rising or are holding steady at increased levels. Especially the sectors that hit closest to our bank accounts. Food, gas, and natural gas are prime examples as illustrated in the following charts.

Below is a chart of an Agriculture ETF from Stockcharts.com. This chart represents corn, wheat, coffee, etc. and illustrates the rapid increase in the cost of food.

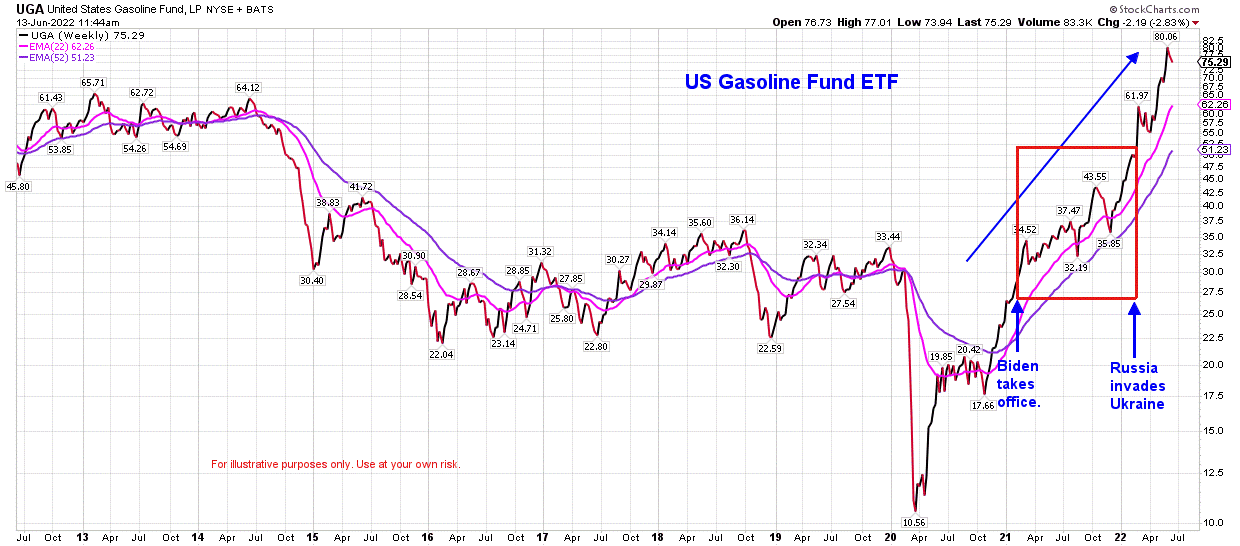

The next chart shows the increase in the price of gasoline since 2020. The increase can be attributed to several things.

- Coming out of the pandemic, demand for gas rose, which would naturally increase the price.

- President Biden’s policies cut the supply of oil while demand for oil was still going up, which has driven up the price of oil.

- In February of 2022, Russia’s invasion of Ukraine, both major oil and gas producers, has also contributed to the price increase.

Not only does it cost more to drive your car, it also costs more to have goods delivered to the businesses that supply us with what we need, so they, in turn, pass those rising costs along to the consumer.

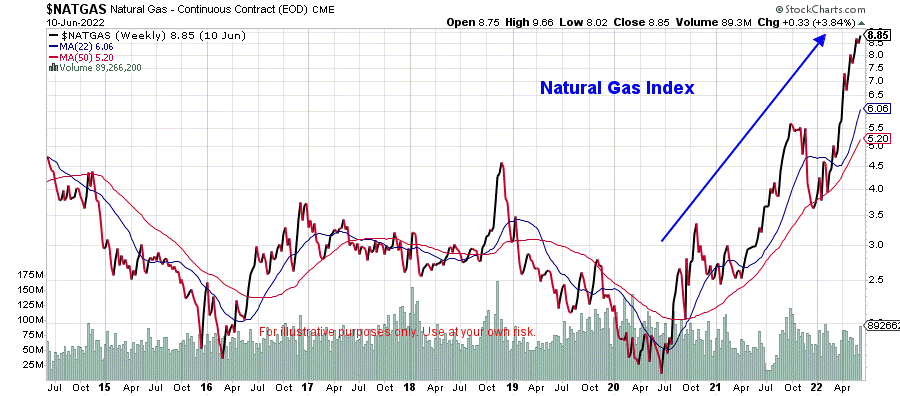

The last chart shows the increase in the price of natural gas since 2020. In 2021, 37% of US natural gas consumption was for the production of electricity, which means the cost to power our homes and businesses will continue to go up as well.

These examples seem to indicate that inflation is not slowing down, and, when you consider the $5 trillion of stimulus that the government has pumped into the economy, it will take a while for the money supply to contract to levels that don’t contribute to inflation. The primary tool that the Fed uses to contract money supply and get inflation under control is by raising interest rates. Unfortunately, once inflation is under control, interest rates could be significantly higher. Also, consumer sentiment is at an all-time low which typically means spending will slow down. While that helps with inflation, it increases the likelihood of a recession—where producers of goods and services will see their bottom line shrink causing stock prices will fall.

The current economic environment looks to be headed into a more and more difficult direction with a lot of variables that make forecasting whether we are headed into more inflation or into a recession hard to predict. So, the best course of action is to be prepared to go in either direction. Economic downturns create really good opportunities for those who don’t panic and are looking for those opportunities.

Recent Comments