Recently I looked at our family budget to compare how much more we were spending on groceries and fuel in 2022 versus 2021 and 2019. I skipped 2020 as it was such an odd year due to covid. I knew we were spending more even though it felt like we were buying less, so I did some quick back-of-the-napkin calculations. To no one’s surprise, we were spending a lot more. From 2021 to 2022 (so far) spending on food was up 30% and fuel 27%. From 2019 to 2022, food increased by 45% and fuel 33%. Ouch!

The question then arises as to how to invest during these inflationary times in order for assets to keep up with inflation. First, let’s define what inflation is and how it is measured and then look at which type of assets perform best and worst during an inflationary cycle. Then we will look at some examples of how some of these assets are currently performing. Current performance leaves me with some questions.

What Is Inflation and How Is It Measured?

Inflation is defined as an increase in the price of a basket of goods and services over time. The basket represents a pattern of goods and services that consumers are buying during a certain time frame. The percentage change of the price in the basket over the specific time frame represents the rate of inflation. The Bureau of Labor Statistics (BLS) is the governmental agency that accumulates the data and calculates the rate of inflation.

The BLS also calculates other economic statistics like the Consumer Price index (CPI) and Producer Price index (PPI) that dig deeper into the nuts and bolts of the economy, but, for now, I want to look at investments from an inflationary point of view.

Which Assets Perform Best or Worst during Inflationary Periods?

People who live on a fixed income are an example of those who suffer from the effects of rising inflation. As prices go up, their dollars buy less goods, and at times this can be very difficult for this demographic. This also applies to bonds with a fixed rate of interest. The rate of interest the bond pays is fixed; therefore, it cannot keep up with the rate of inflation, so these bonds become less desirable to investors. So, any debt security that has a fixed rate is going to perform poorly during an inflationary period.

Real estate, commodities, certain sectors of stocks, Treasury Inflation Protected Securities (TIPS) are all examples of investments that historically tend to hold or increase in value better during times of inflation.

- Income-producing real estate does well as rents can be increased periodically, but understand how these properties are financed as rising rates can negatively impact some property.

- Commodities tend to be tangible assets. Gold and silver have always been considered a hedge against inflation. Agricultural products and raw materials like copper, oil, and natural gas are also examples of commodities.

- TIPS are tied to the Consumer Price Index (CPI), so when CPI rises, the value of TIPS does, too. TIPS also have a variable interest rate that is tied to the base value. Therefore, when the base value increases, so does the rate of interest.

- Junk bonds, or high-yield debt, already pay a higher rate of interest than regular corporate bonds because they are a riskier asset. Investors tend to move into junk bonds during inflationary times in order to get a higher rate of interest and as a result the value of the bonds increase as well.

- Stocks can often do a good job of keeping up with inflation as long as the companies behind the stock have the ability to pass along their cost increases to their customers.

How Are Inflationary Assets Currently Performing?

Gold is historically considered to be the standard when hedging for inflation, yet it has trended sideways to slightly down since mid-2020. If inflation were surging upwards, I would expect to see the Gold chart below in an uptrend. Since May 2022, gold has continued to move downwards below its moving averages. Other commodity charts shown below also indicate that inflation may be slowing or come to a stop.

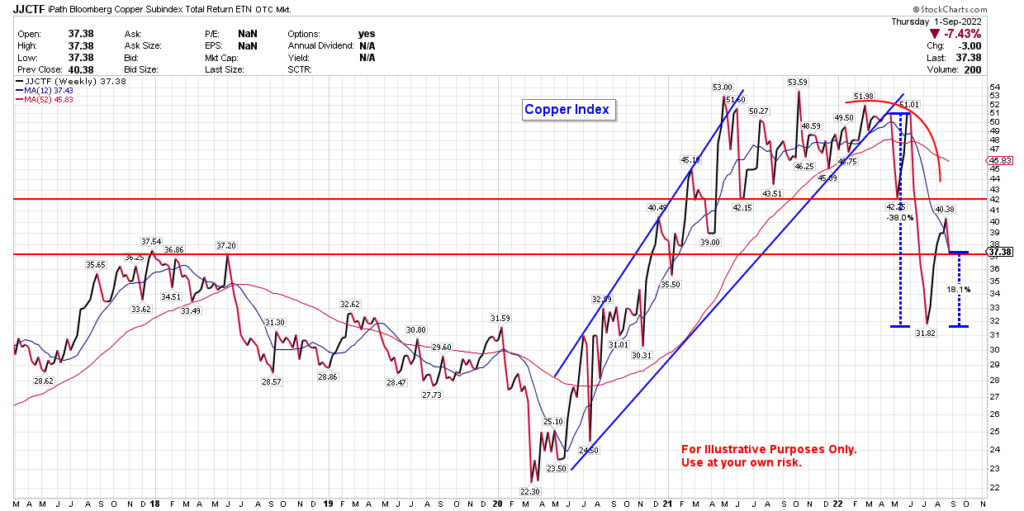

Copper is a good material to use to evaluate the state of the economy because it is used heavily in homebuilding and other production methods. It moved sideways since the middle of 2021, and this summer dropped 38% before rebounding about 18% to its early 2021 level.

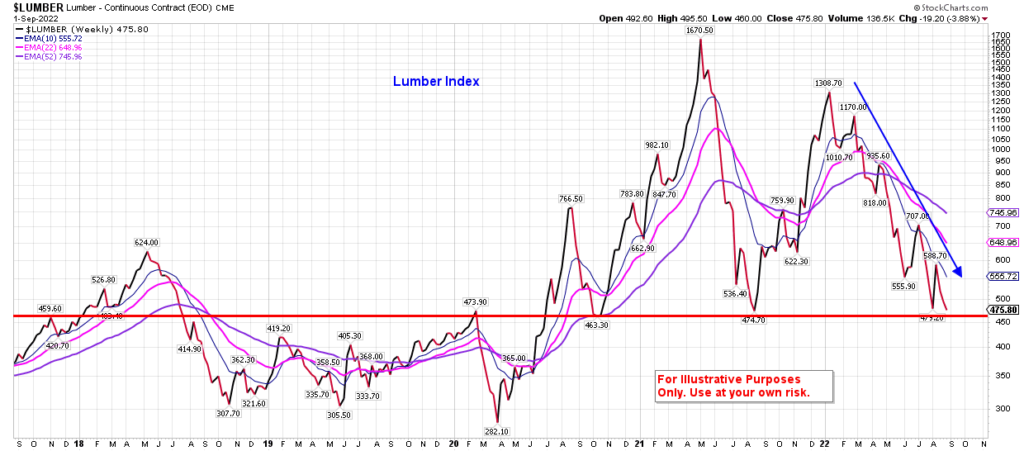

Lumber has been a very volatile commodity for the last two years. It has fallen this year to a level of resistance that it bounced off of in 2020 and 2021. This is one to watch through the rest of the year to gauge the direction of inflation. But, right now, lumber does not seem to indicate inflation is rising.

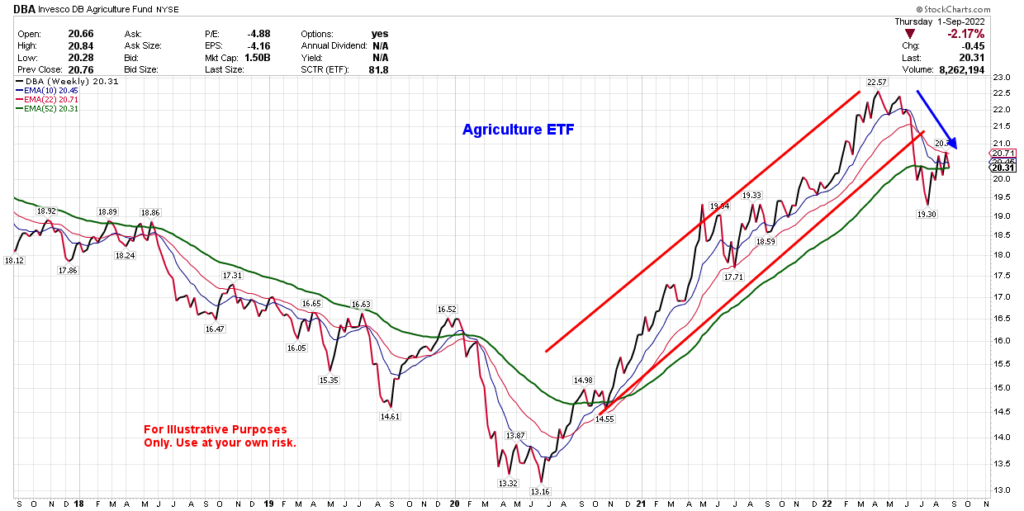

The Agriculture ETF chart below shows a huge uptrend from the middle of 2020 till the spring of this year, and then it turns down sharply through the summer. Currently, it has leveled out around its 52-week moving average.

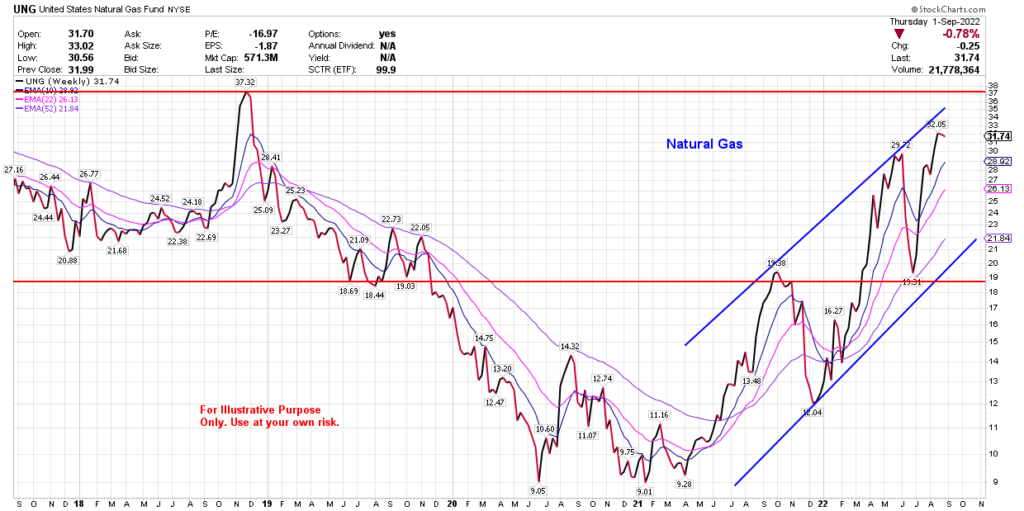

Natural gas is one commodity that continues to trend upward—primarily due to the Ukraine/Russian war which is creating shortages around the world. From reports I’ve read, it will likely be a cold winter in some European countries this year because Russia is their main supplier of natural gas. Utility companies are also trending up as everyone continues to pay their bill and the utility companies are able to pass along their price increases to the consumer.

Has Inflation Abated?

Unless there is a specific scenario, like a war, many of the commodity sectors seem to have either moved sideways or turned over and broken down, out of their uptrend for now. Does this mean inflation has slowed or stopped all together? Because all the economic indicators the BLS uses to measure inflation are lagging indicators, we won’t know officially if inflation has abated or not until months after the fact. But looking at commodities such as these and looking at your own spending for things like food and fuel can give you some insight on how to invest.

While having knowledge about investing during inflation is great, implementing an investing strategy to combat inflation after inflation has stopped will be a frustrating endeavor.

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor, who can deliver current information to you quickly and offer help with sorting through the various investing options.

Bret Wilson – Financial Advisor in Rockwall, TX

Recent Comments