Has Inflation Peaked?

Last week’s surprisingly positive Consumer Price Index (CPI) number created an upward surge in the market on Thursday and Friday. The October CPI was released, and the core rate of inflation at the consumer level rose by 0.3%, which beat the expectation of a 0.5% increase. Though that doesn’t seem to give much cause for the S&P 500 to jump 5.54% last week, unless Wall Street thinks inflation has peaked or is close to it. If true, the Fed could begin to slow and eventually stop with the rate hikes.

Past vs. Future

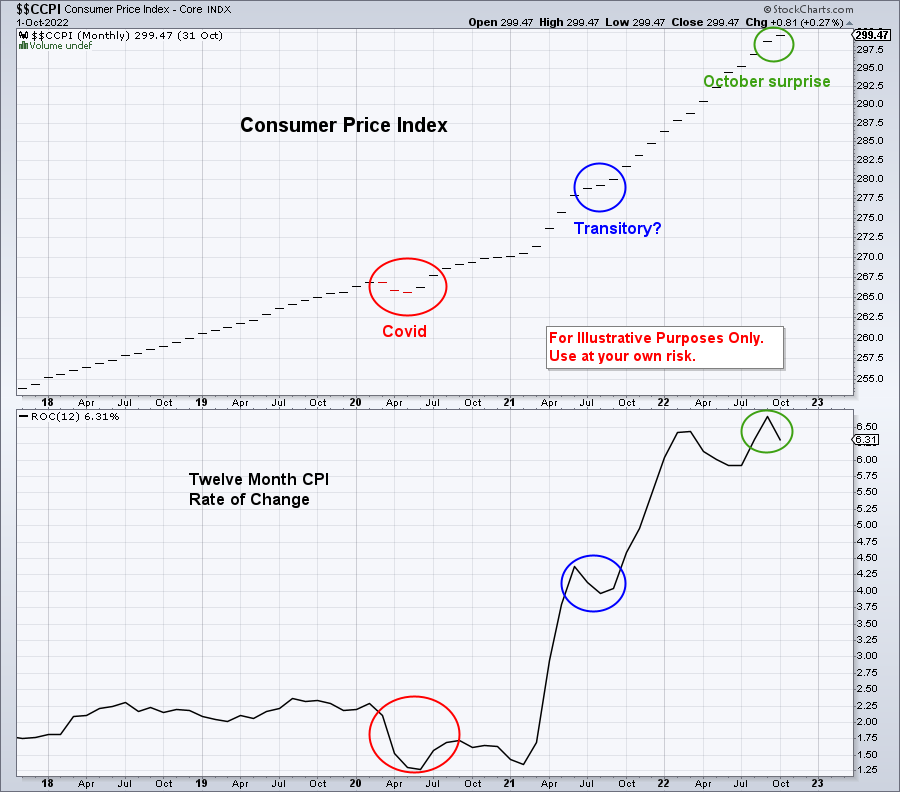

Below is a chart that shows the CPI over the last 5 years.

In the top chart, the red circle shows that during the early phases of Covid the CPI actually decreased, which is very rare. The blue circle in the top chart lines up with the blue circle in the bottom chart, which showed inflation was slowing down in the summer of 2021. At that time, Treasury Secretary Yellen, Federal Reserve Chairman Powell, and President Biden assured us that inflation was “transitory” and was beginning to abate. When that didn’t happen, the Fed began with the first of four interest rate hikes, with at least one more coming in December. Rate hikes take several quarters to impact the economy. Since we have not felt this yet, inflation may have already peaked. The green circles in the upper and lower chart show the recent change in the CPI. Once the economy begins to actually feel the effect of the rate increases, then inflation or the core CPI number could very likely drop over the next three months, meaning the Fed would stop increasing the interest rate. Two weeks ago, I stated that I thought we were in a bear market rally and that the rally would eventually lose steam unless something surprised us. Because the “October Surprise” occurred, this could be the beginning of a change in the market’s trend.

Fed’s Wet Blanket

Just as the Fed was late in recognizing the inflationary conditions that existed during 2021, they will now be overly cautious when it comes to recognizing the weakening of this inflationary cycle. When Federal Reserve Governor Christopher Waller, a member of the Federal Reserve Board of Governors, spoke to the press over the weekend, he confirmed their cautious approach.

These rates are going to stay—keep going up—and they’re going to stay high for a while until we see this inflation get down closer to our target. We’ve still got a ways to go. This isn’t ending in the next meeting or two. We’re looking at moving in paces of potentially 50 [basis points] at the next meeting or the next meeting after that. We’ve got to see this continue because the worst thing you can do is stop [tightening conditions] and then it takes off again, and you’re caught. The market seems to have gotten way out in front over this one CPI report. Everybody should just take a deep breath, calm down. We’re going to see a continued run of this kind of behavior and inflation slowly starting to come down, before we really start thinking about taking our foot off the brakes here. We’ve got a long, long way to go unless by some miracle incomes start dropping off very rapidly, which I don’t think anybody expects. Rates are going to keep going up and they are going to stay high for a while until we see this inflation get down closer to our target.

Next CPI Number

Of course, something unforeseen could pop up over the next three months that changes this whole narrative, and the bear market could continue. But the probabilities that we are getting closer to the end of this cycle continue to improve. The November CPI report will be released on December 13th at 7:30am CT just as the Fed begins its December meeting, and I will be watching to see if the data confirms what I’m expecting.

Disclaimer

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options.

Recent Comments