January Excitement

January turned out to be one of the best months the stock market has seen since 2019, and the first day of February wasn’t too bad, either. When you consider that the Federal Reserve’s board members met today and voted to raise short-term interest rates by a quarter percentage point, and yet the markets went higher (lead by the Nasdaq climbing 2%), it could lead us to think some positive momentum is being built.

Fed February Meeting

The Fed statement, released after the meeting, acknowledged that inflation has eased but still remains elevated. As long as inflation stays elevated, the Fed will maintain restrictive monetary policy because “The Committee is strongly committed to returning inflation to its 2 percent objective.”

The markets were anticipating the rise in rates this month and are also expecting another quarter-point increase next month. But any increases or hints of increases beyond that will put downward pressure on markets. So far, the Fed has indicated that they will step back after the March meeting and review the effects their rate increases and their bond buying are having on the economy.

With no big surprises coming out from the meeting, the markets rallied in the closing hours today. Following a strong January, February could also be a strong month. Of the top 20 January performances of the S&P 500 since 1950, when the S&P finished the month up around 4%, 18 of those years’ returns have been positive, and 14 of those years showed gains of at least 10%. Obviously that doesn’t mean that it will happen again this year. There are no guarantees and any unforeseen event or Fed surprise could bring increased volatility to the markets, which is something you have to be prepared for, always.

What’s Our Next Move?

When the markets have a significant move up, it’s prudent to look at how many stocks are actually participating in the move.

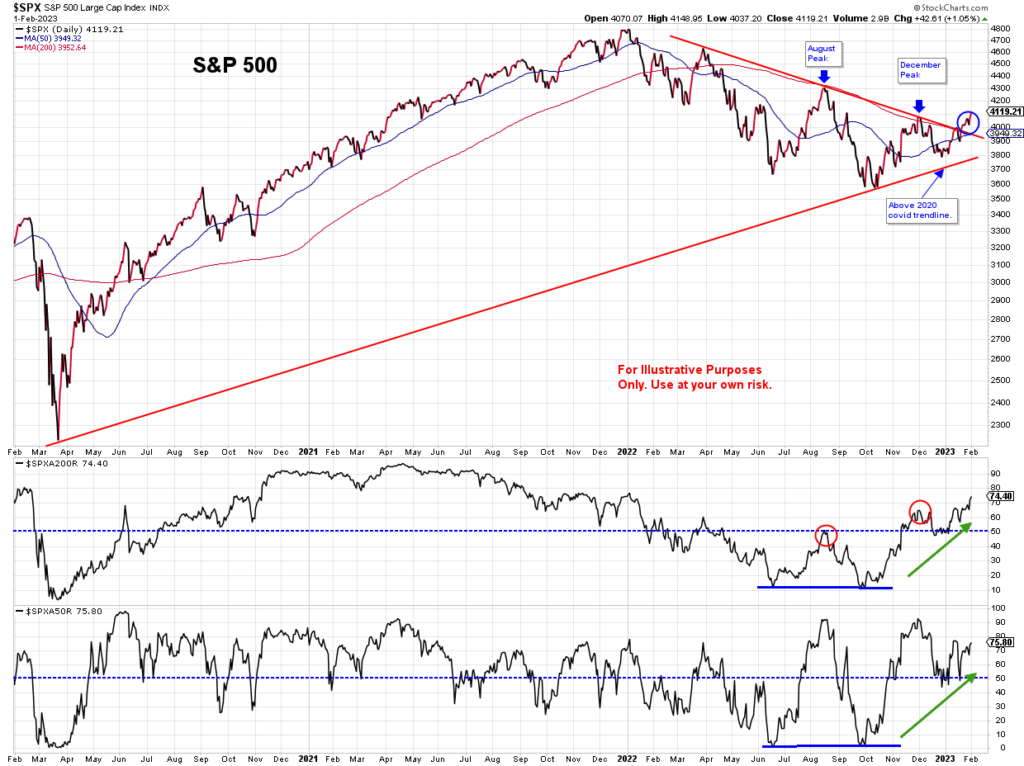

Below is a 3-year daily chart of the S&P 500 after today’s close. Under the price chart are two more charts that reflect how many stocks in the S&P 500 are above their 200-day moving average (MA) and 50-day MA. The number of stocks above their 50-day moving average has a lot of volatility over any time frame and makes it a little less useful. But the 200-day moving average chart currently indicates that over 74% of the S&P 500 stocks are now over the 200-day moving average. When the market peaked in August around 4300, less than 50% of these stocks were over the 200 day. But since early November and even after the December pullback, over 50% of the stocks have stayed above the 200-day moving average. The more stocks that participate in the runup means the index price increase is stronger.

If there are only a small number of stocks or a couple of sectors that are widely outperforming the rest of the market, then the move up is not likely to last. For example, the Dow Jones Industrial Average only measures 30 large-cap stocks, so it’s not hard for a few outperforming stocks to have a large influence on the total performance of the index and give the false impression that all 30 stocks are doing well.

Take The Emotion out of Investing

This past year was a rough one for investors who used the buy-and-hold method. Even if you actively managed your portfolio, you still had to have a lot of patience as the markets followed each rally with another leg further down. If you got back in too early, you were usually punished. That type of negative reinforcement makes people hesitant to dip their toes back in the water if they are being influenced by their emotions. Investors need to find a system that works for them and stick with it. If you don’t think you have the time to learn the system, or you’re not certain you’ll be able stick with it, or your emotions end up getting the better of you, find a financial advisor with a system that works, and let that person manage your portfolio for you.

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options.

Bret Wilson is a Financial Advisor based in Rockwall, TX

https://wilsoninvestmentservices.com/2022/12/15/whats-lurking-around-the-corner/

Recent Comments