A Day at the Park

Years ago, my wife and I would occasionally take our kids to Six Flags for some family fun. We spent the day riding the rides, eating overpriced food, and getting sunburned. It was great family bonding time, and the kids loved it. Sometimes we would get lost or couldn’t remember where a certain ride was, so we looked for the park map that was posted in various spots around the park. Once we located a map, the first thing I would look for was the red dot that indicated our location with the words, YOU ARE HERE. Identifying where we were helped us get our bearings and know which direction to go next.

Doing this same exercise with respect to your investment portfolio can give you greater confidence and stability. It’s important for investors to occasionally step back and look at the map to determine where we are with regard to the U.S. economy. This gives us an idea of where we are, what is coming, and which direction to go next. Because of the issues in the banking sector that have been making headlines, I want to look at the credit cycle as it relates to lending, interest rates, and the Federal Reserve.

Look For the Red Dot

To illustrate the credit cycle, I’m going to borrow a list from another blog post by Cullen Roche at Discipline Funds (Is the credit cycle different this time ).

- Economic expansion

- Economic expansion turns into economic boom

- Inflation moves above Fed target (Target is 2%)

- Fed raises rates

- Rate hikes lag so Fed keeps raising

- Yield curve inverts (Long-term rates lower than short-term rates)

- Fed continues to raise rates as inflation data remains sticky

- Consumers borrow more to make up lost income in slowing sectors

- Lending standards increase as credit quality deteriorates (YOU ARE HERE)

- Economy slows as credit expansion erodes

- Recession

- Fed reduces rates

- Rinse, wash, repeat

With the rise in interest rates and all the issues in the banking industry currently, it doesn’t take a genius to figure out that lending is slowing down. So, if small businesses are not borrowing to expand and potential homebuyers are not taking on mortgages, then we are somewhere around #9 to #10 on the list.

Banking Woes

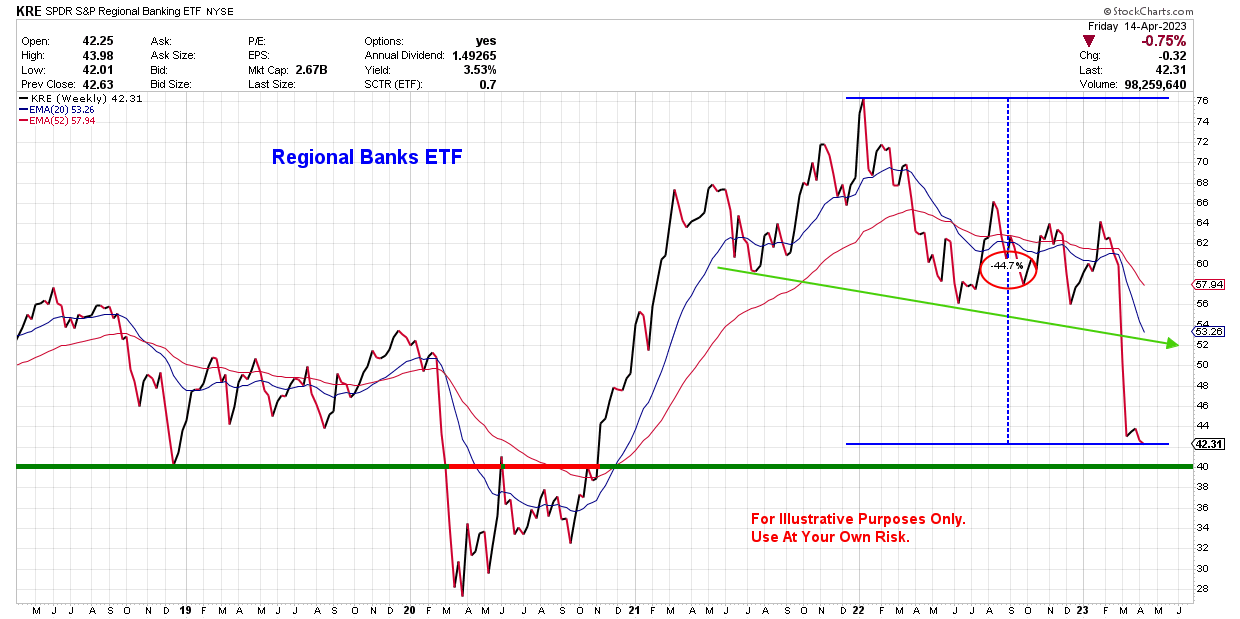

Below is a chart of the Regional Banking ETF, KRE. You can see that around the end of January this year, the bottom dropped out of this fund. It is down a whopping 44.7% since its high at the beginning of the year.

This indicates that the next step in this cycle should be a recession. The question is, how deep a recession will it be and how long before the Fed realizes we are in a recession and begins cutting rates? The answer depends on who you listen to. I’m not sure who has the right answer at the moment, but if we are fairly certain a recession is coming, then, as I said earlier, we can know which direction to go next.

Behind The Curve

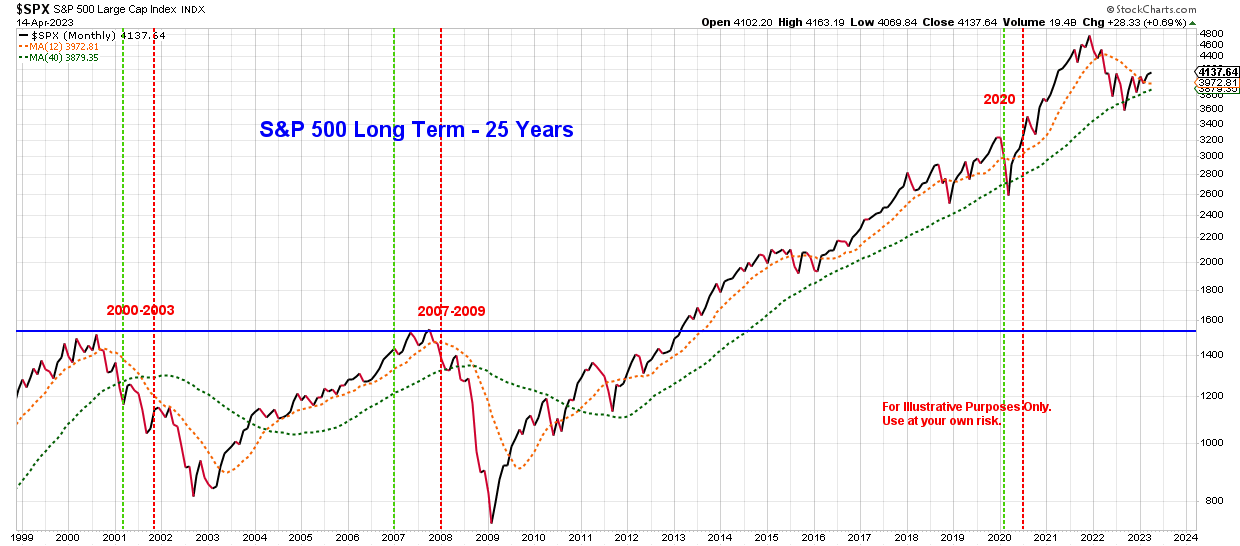

Typically, the markets have bottomed long before the Fed tells us we are in a recession. A look at the 25-year monthly chart below of the S&P 500 indicates when the last three recessions started—the horizontal green line—and when the Federal Reserve announced we were in a recession—the horizontal red line.

In 2003 and 2020, the recessions were over and the markets had bottomed by the time the announcement came that we had been in one. In July 2009 the Fed announced the 2008 recession was over and the stock market had already bottomed four months earlier. The point is, don’t wait on the Fed in order to make your investing decisions. They use backward looking data, while the stock market uses forward looking data.

Plan of Action

Defensive sectors and stocks like utilities, healthcare, and consumer staples generally hold up well during recessionary timeframes. Short-term government bonds can also be a good place to park cash until the recession ends. Whatever you do, have a plan, be patient, and look for good opportunities.

________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.

Recent Comments