Good News for the Economy

This week the monthly Consumer Price Index (CPI) and the Producer Price Index (PPI) were released right before the monthly Federal Open Markets Committee (FOMC) meeting. CPI revealed May inflation up 0.1% which means inflation increases are slowing down when compared to the 0.4% April increase. Year over year, CPI inflation is up 4% in May versus last month’s report of 4.9%.

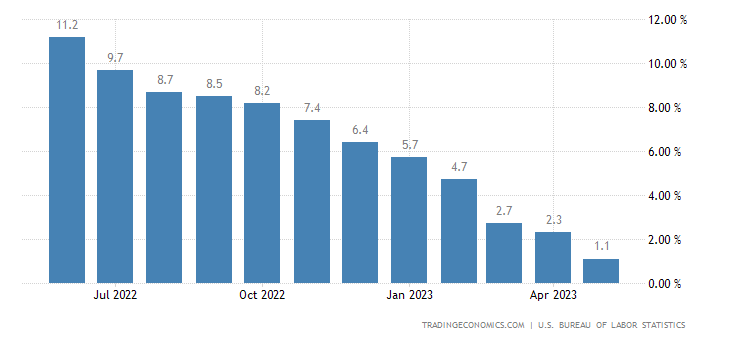

The PPI, which looks at wholesale prices for materials that manufacture’s use, fell 0.3% in May. Annual price increases were up 1.1% for the last 12 months which is an improvement from the 2.3% recorded in April. Bottom line, the wholesale prices for producers has dropped to its lowest level in two years, and the CPI inflation rate at 4%, while still above the Fed’s target rate of 2%, is coming down. As a result, the Fed paused its rate hikes this week but left open the possibility of two more rate hikes of .25 basis points each over the course of 2023. Below is a chart from https://tradingeconomics.com that displays the last 12 months level of the PPI.

Market Reaction

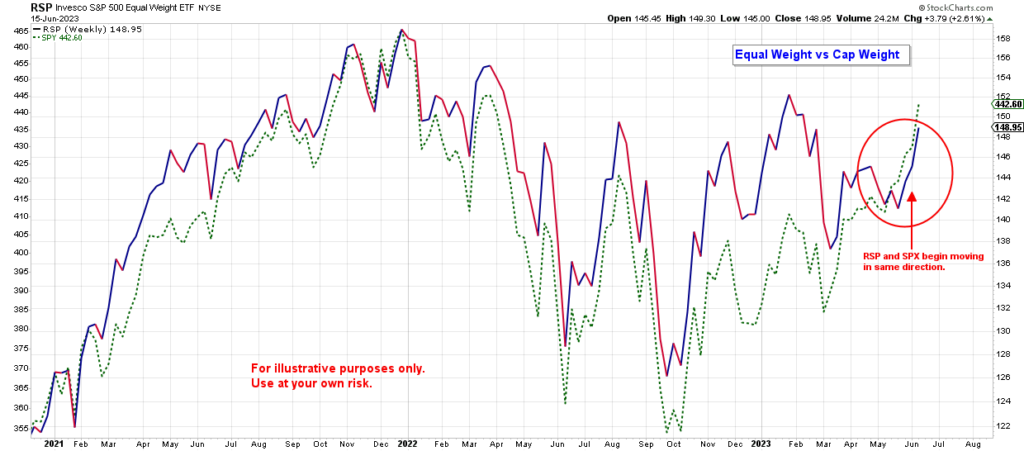

Since markets hate uncertainty, the recent resolution to the debt-ceiling issue, the regional banking crisis seeming to settle down, and the cooling off of inflation have created some tailwinds for investors. While technology and communications have been leading the way in the markets this year, other sectors are starting to perform positively as well. Instead of just the bigger tech firms moving upwards, there is broader participation in the markets as seen in the equal weighted S&P 500 ETF, RSP vs the S&P 500 ETF, SPY.

The equal weight RSP looks at every company in the S&P 500 equally despite their size differences, while SPY gives more weight to the value of the larger companies within the ETF. When compared, if SPY is outperforming RSP, that can mean that only the larger companies in the S&P 500 are performing well, while the rest are lagging behind. But if RSP and SPY are moving in tandem, then that means there is broader participation from many more S&P companies and thus, many more sectors of the economy. Below is the chart for RSP with an overlay of SPY (dotted line). Note inside the red circle how the dotted line and the solid line have been moving together since late May.

What Do We Do with Good News?

Don’t get too excited about the recent developments. Inflation is still above the Fed’s target rate, and they could hike interest rates two more times this year which could put a damper on our happy dance. Also, some economists are still calling for a recession this year if unemployment starts ratcheting up, but that all means we are moving further down the road and out of a sluggish economy.

As always, have a plan, be patient, flexible, and look for good opportunities.

________________________________

This post is for informational purposes only. It is not intended as investment advice as each person’s financial situation is different. I strongly recommend working with a financial advisor who can deliver current information to you quickly and offer help with sorting through the various investing options. Bret Wilson is a Financial Advisor with Wilson Investment Services, based in Rockwall, Texas.

Recent Comments